Reading Between the Lines: Analyzing QCOM's Prospects Amidst Market Volatility.

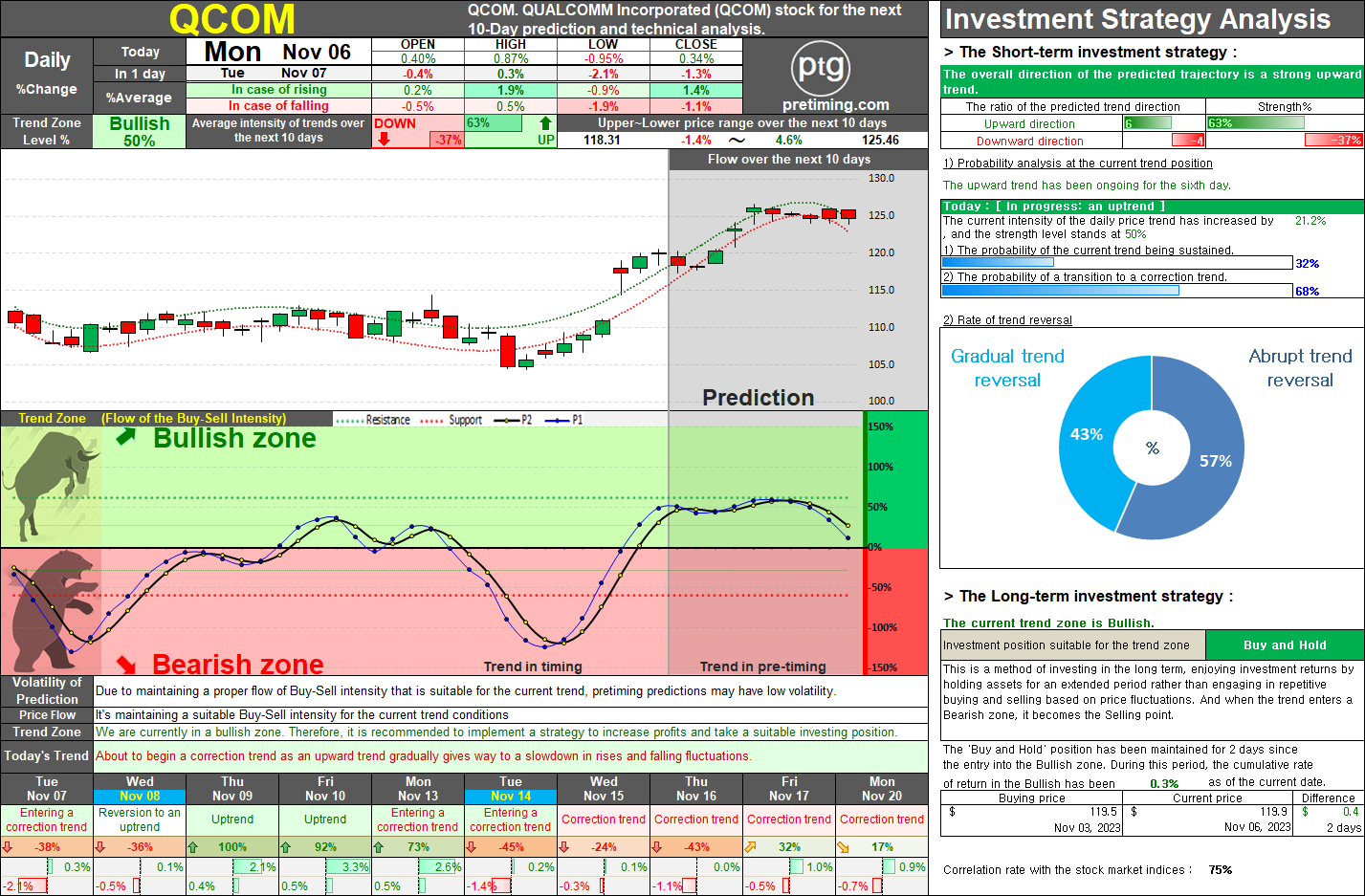

QUALCOMM (QCOM) Daily Stock Analysis QUALCOMM's daily stock entered the bullish zone two days ago, indicating an ongoing uptrend. However, on Monday, November 6th, the market displayed a weakening buying strength within the existing uptrend, suggesting an imminent corrective phase. This correction trend is anticipated to continue briefly over the next 1-2 days, followed by a potential re-entry into the bullish zone. Even in the event of a return to the uptrend, it is expected to be short-lived, swiftly transitioning back into a corrective trend, which is likely to persist from the middle of the next week onwards. During this correction, buying strength is expected to diminish further, while selling pressure gradually strengthens, leading to a significant and prolonged downturn. As this pattern persists into mid-November, the daily trend is highly likely to shift from the current bullish zone to the bearish zone. Towards the end of November, an overall downtrend is expected to domin