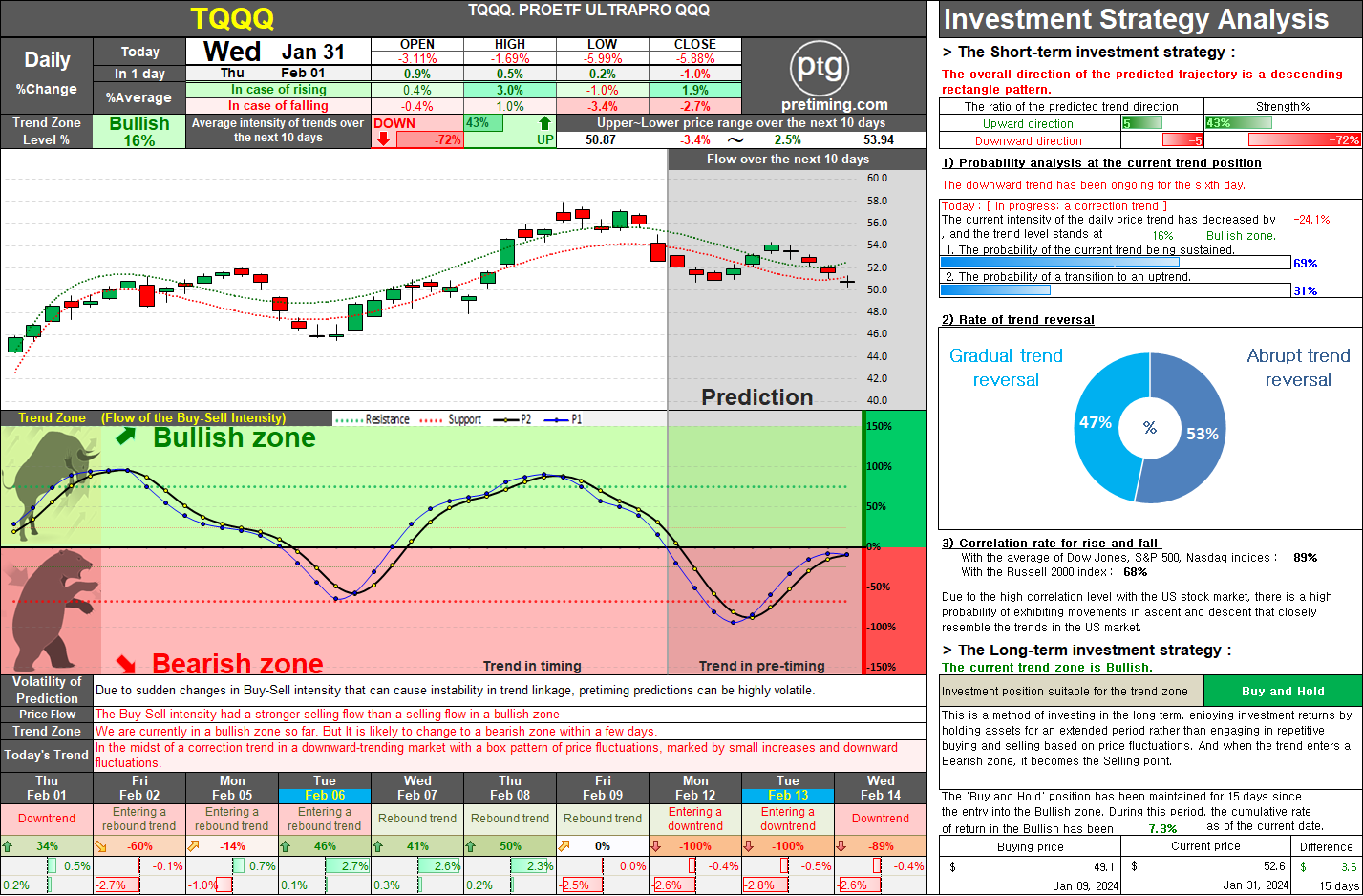

TQQQ. Strategic Analysis and Investment Recommendations in a Bullish Stock Market Trend.

Feb 07, 2024 TQQQ stock closing price 58.3 2.98% ◆ [Long-term strategy] The current trend zone is Bullish. and Investment position suitable for the trend zone is Buy and Hold. The trend within a Bullish zone is divided into an 'Uptrend' in the upward direction and a 'Correction Trend' in the downward direction. In the Uptrend, there is a strong upward flow with occasional downward movements, while in the Correction Trend, there is a fluctuating flow involving limited or temporary downward movements and upward fluctuations. Investing in this zone is associated with high expected returns and a low risk of decline. In a Bullish zone, the potential for strong buying pressure is maintained, leading to a robust upward trend and a relatively mild correction trend. When viewed through a medium to long-term investment approach, if the trend continues to move in the