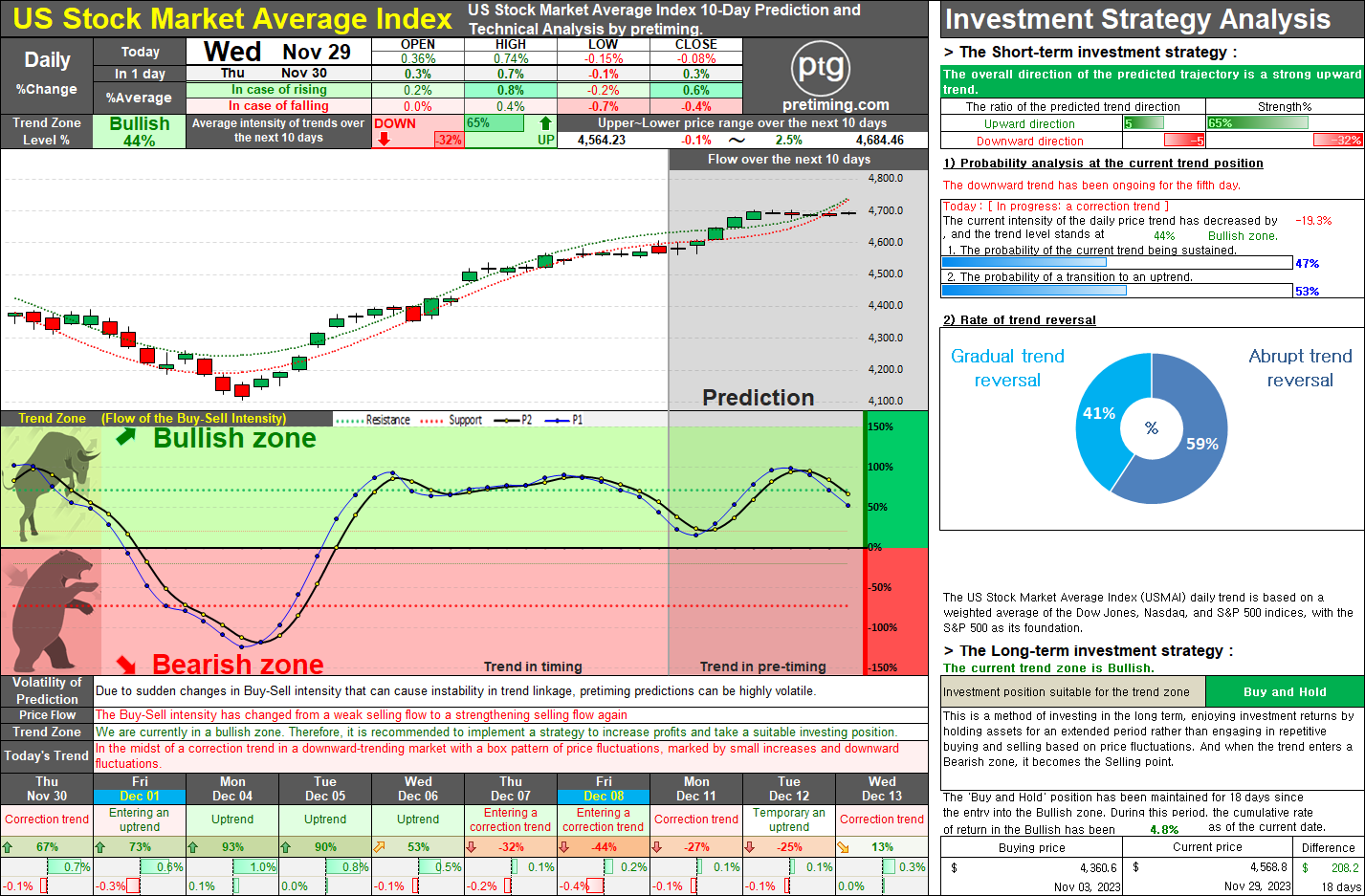

Analyzing the Daily Momentum: U.S. Stock Market Poised to Return to Bullish Territory.

The daily trend of the U.S. stock market's average index indicates a momentum towards entering an upward trend today, and it is expected to soon transition back into an uptrend. However, even in the event of a shift to an upward trend, it is anticipated that after a brief period of advancement, the overall projected trajectory will experience a corrective trend, starting from early next week. Nov 30, 2023 ◆ Closed price 4,591.10 0.49% ◆ Appropriate Investment Position: Bullish-Buy [Long-term strategy] ◆ Today's Buy-Sell intensity analysis The current trend appears to be 'Entering an uptrend'. The OPEN-price started with a suitable upward rate for the current trend and The HIGH and LOW prices are showing an appropriate HIGH-price to the current trend and a stronger LOW-price Finally, the CLOSE-price closed with a suitable upward rate for the current trend. The overall buy-and-sell intensity indicates that the buy intensity is stronger than the sell. Assuming