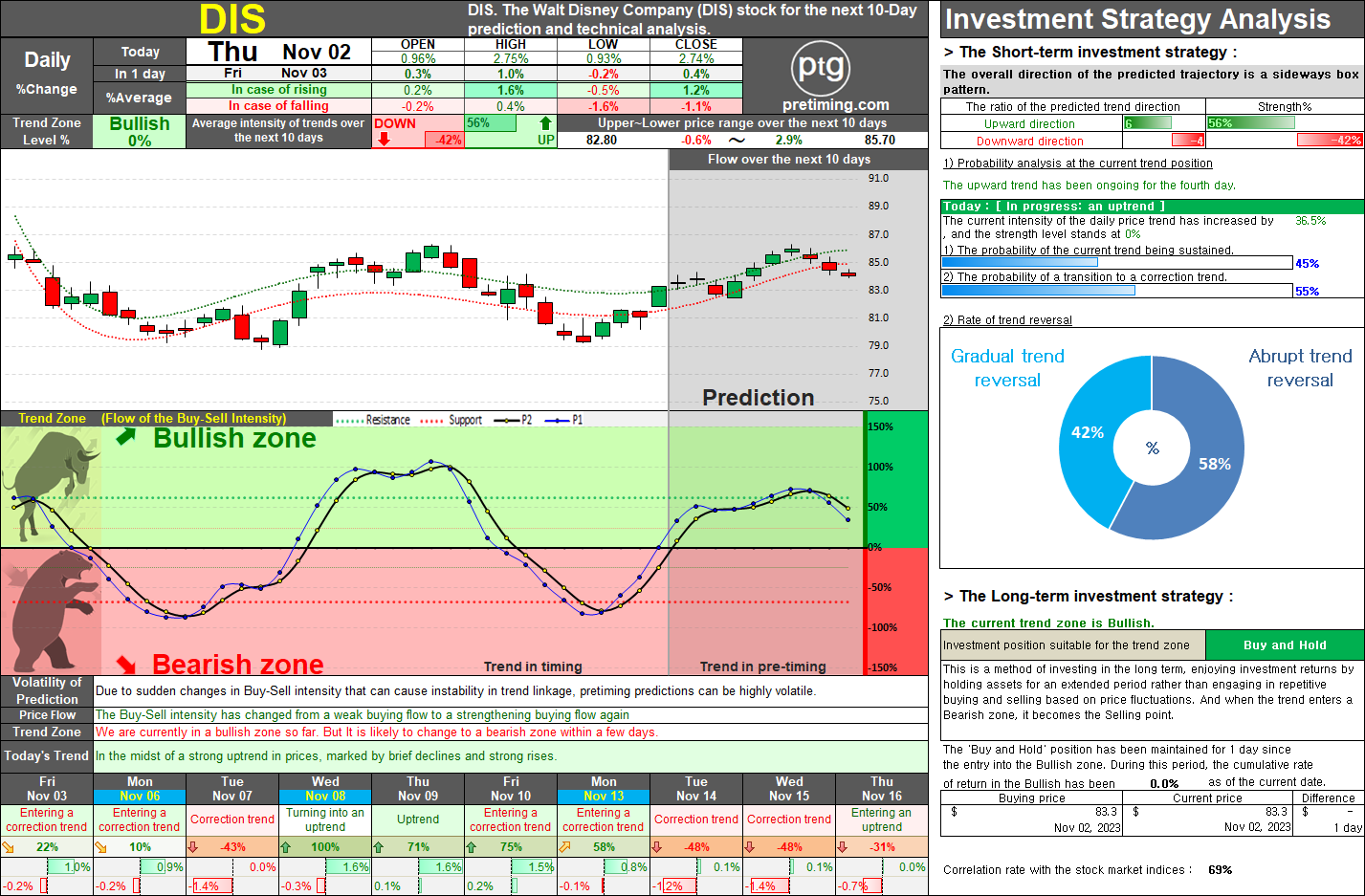

Analysis and Forecast of The Walt Disney Company (DIS) Daily Stock Performance.

Executive Summary: The Walt Disney Company's daily stock performance has recently entered the Bearish zone, indicating a period of decline. Over the past four days, the stock has shown signs of weakening selling pressure and temporary strengthening buying pressure, transitioning from a downtrend to a minor uptrend. As of November 2nd, the stock has entered the Bullish zone, suggesting a potential reversal in the trend. Short-Term Analysis (Next 3 Days): In the short term, it is anticipated that the stock might enter a corrective phase over the next three days, exhibiting limited and temporary fluctuations. Despite potential minor upward movements, the overall trend is expected to be subdued. However, a more significant uptrend is anticipated to resume starting from next Tuesday, with an estimated increase of approximately 4% to 5% based on the projected stock price at that time. Medium-Long Term Outlook (Next 1-2 Weeks): Looking ahead to the next 1-2 weeks, a trading range patter