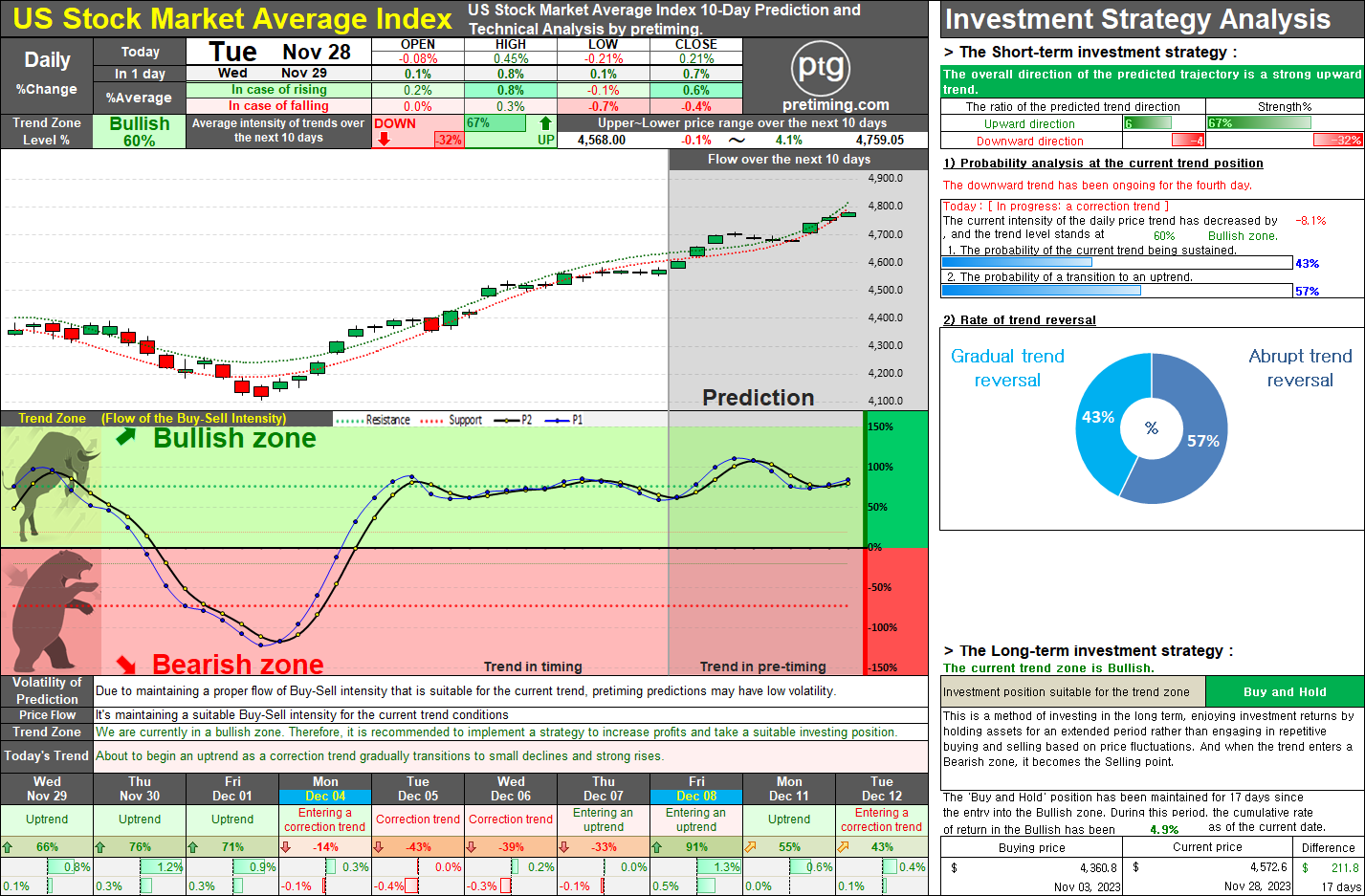

US Stock Market Average Index (USMAI) Daily Trend Analysis.

Executive Summary: The US Stock Market Average Index (USMAI) daily trend is based on a weighted average of the Dow Jones, Nasdaq, and S&P 500 indices, with the S&P 500 as its foundation. Serving as a comprehensive benchmark for the overall trend in the US stock market, the USMAI daily trend entered the Bullish zone 17 days ago, displaying both upward and corrective trend flows. It has accumulated a 4.9% increase since entering the Bullish zone. Recent upward momentum has been constrained, with a correction trend showing fluctuations. However, as of November 28, there are indications of a shift from the correction trend to an upward trend, expected to continue until at least this Friday, November 29. Subsequently, in the following week, a correction trend with weakened buying strength is anticipated, leading to limited fluctuations between upward and downward trends. Market Analysis: Given the ongoing trend in the Bullish zone, overall potential buying strength remains strong,