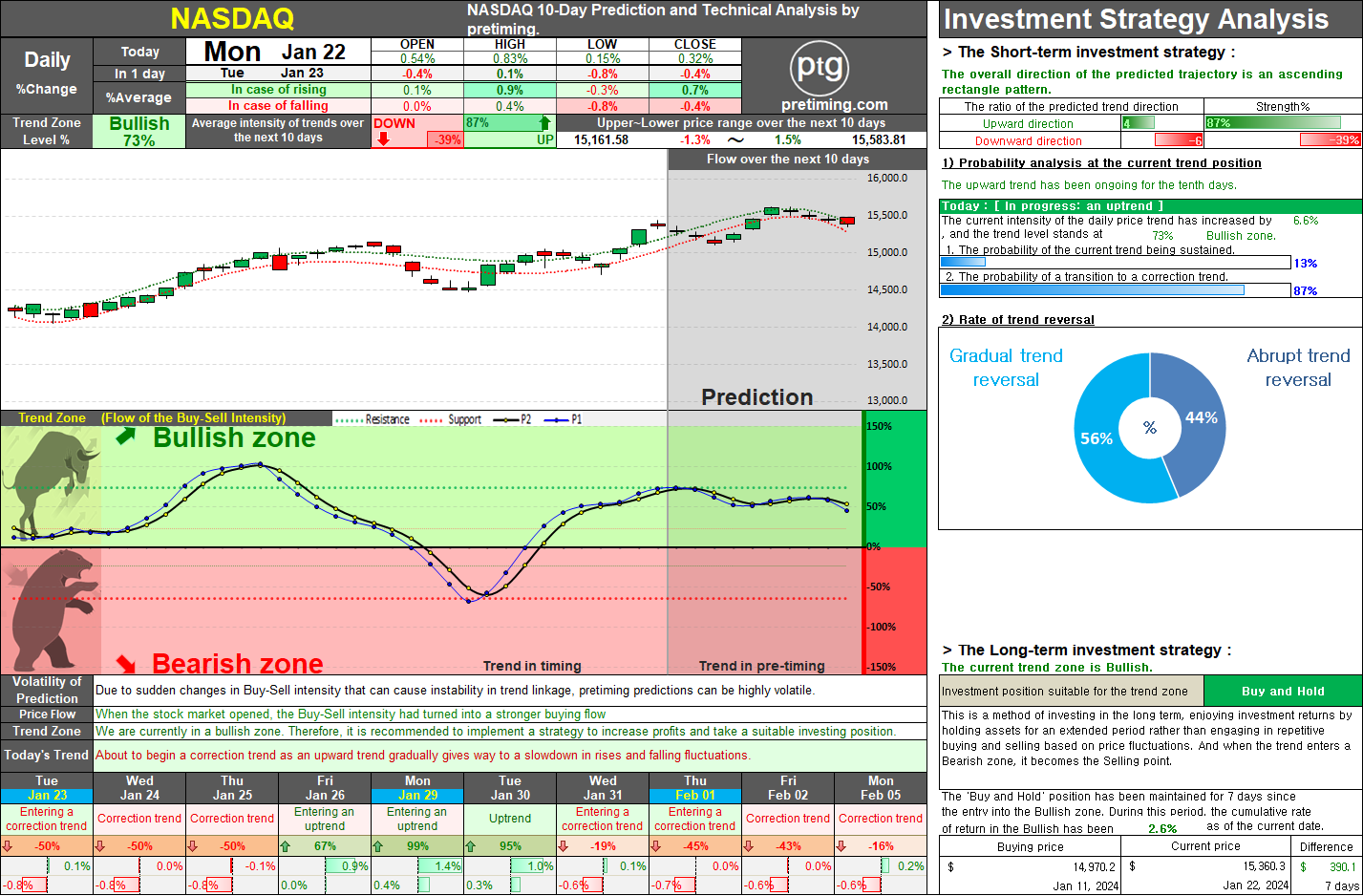

NASDAQ. Market Analysis and Outlook: Navigating Trends in January and February

As of January 22nd, Monday, the NASDAQ index closed with a 0.32% increase, signaling a positive start to the week. The current daily trend remains in the Bullish zone, reflecting a continued upward trajectory. However, we are now approaching a phase where buying momentum is gradually diminishing, indicating an imminent correction trend. This evolving trend is expected to persist until tomorrow, after which a gradual shift towards a correction trend is anticipated. The projected duration of this correction trend is estimated to be around 4 days. We foresee a potential return to an upward trend by the end of this week or early next week, signaling a resurgence in buying strength. Therefore, it seems that the opportune moment to re-enter the market with stronger buying momentum will be around that time. Looking ahead, a generally favorable ebb and flow in market movements are expected until the end of January. However, as we transition into February, there are signs of a weakening buying