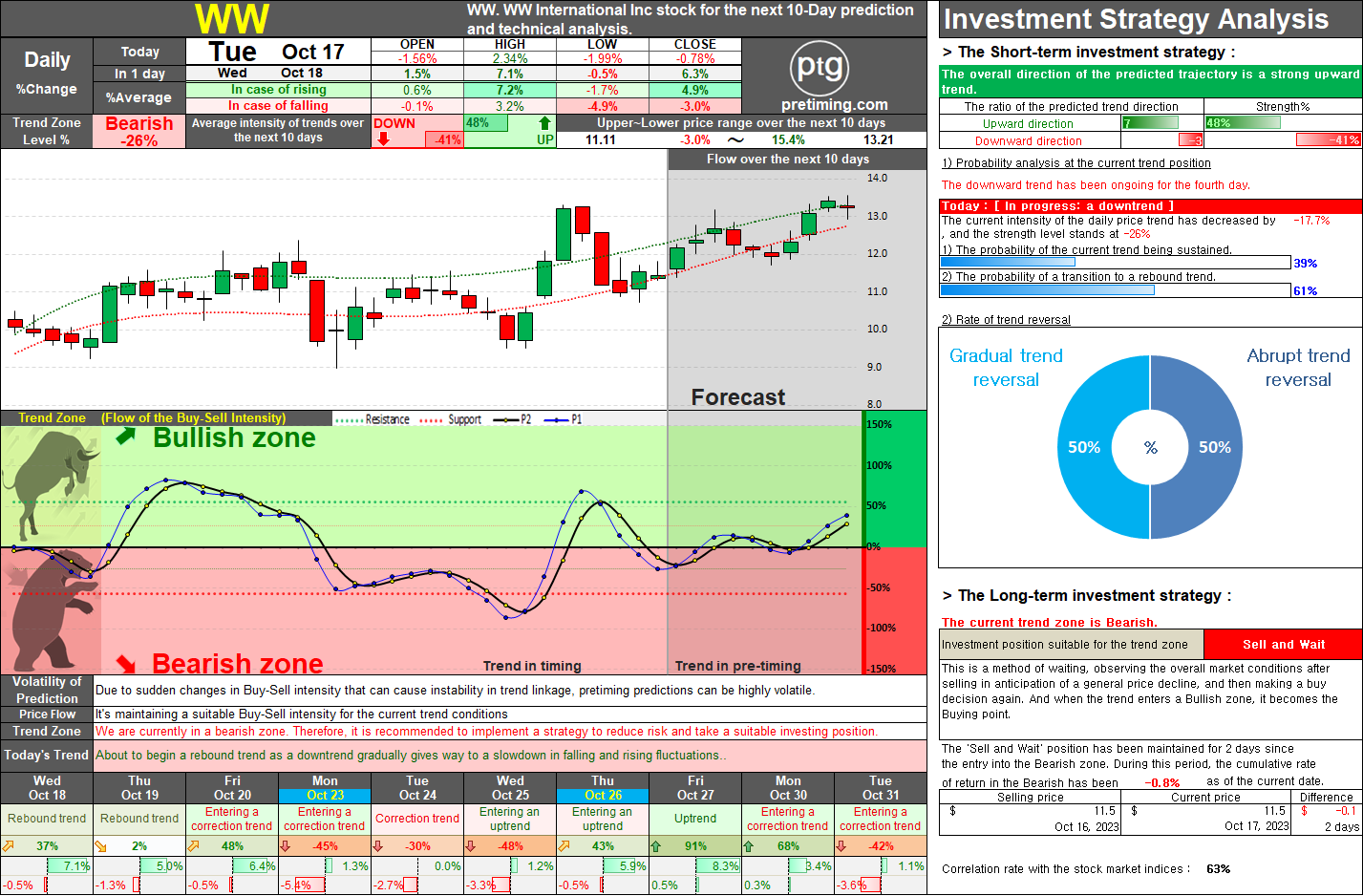

WW International Daily Stock Analysis: Recent Entry into Bearish Zone and Anticipated Market Trends.

WW International's daily stock prices entered the Bearish zone two days ago, showing a weakening selling trend within the current downtrend. Soon, it is expected to transition into a short-term rebound trend for the next 2-3 days, possibly entering the Bullish zone temporarily. However, starting from the next week, a corrective or further downward trend is anticipated. Considering the overall market conditions, the upcoming downtrend is likely to be stronger and more significant than currently predicted. As the trend currently moves within the Bearish zone, the potential selling pressure is high. This might lead to a change in the overall prediction, possibly advancing the onset of the downtrend. While the similarity with the US market is 63%, the uncertain market and investor sentiment might limit the predicted uptrend for the latter part of this week. Considering these factors, preparing a strategy for the upcoming downtrend starting next week is advisable. Updates will be provid