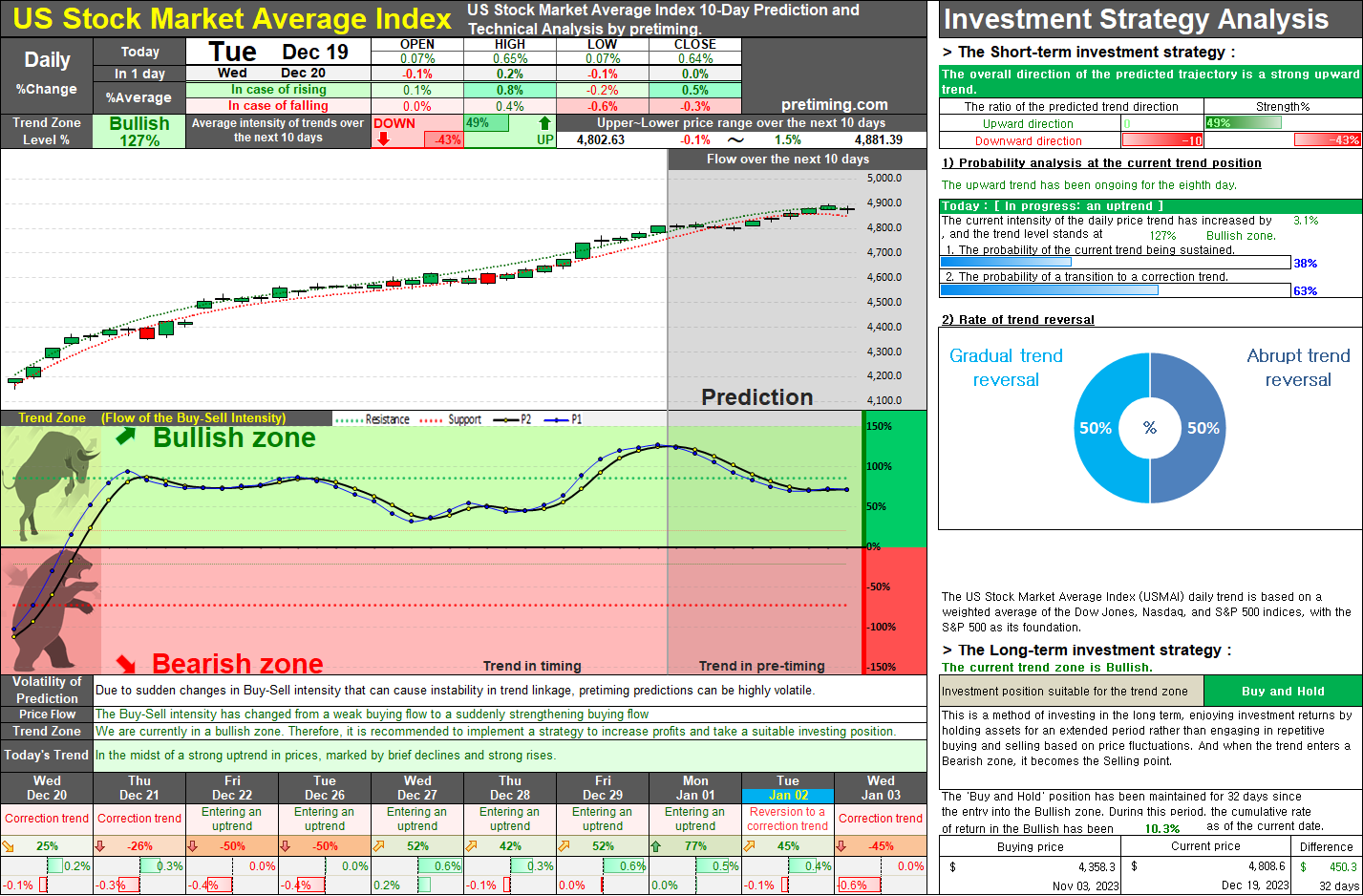

USMAI. Daily Trends: Anticipating a Shift from Bullish to Correctional Momentum.

The daily trend of USMAI is currently progressing in the Bullish zone, but as of December 20th, there is an anticipation of a shift towards a correction trend where buying strength is expected to weaken. In the short term, fluctuations within a sideways trend are expected. It is foreseen that the buying intensity may gradually diminish, and there is a likelihood of a temporary shift in favor of selling strength over the next 2-3 weeks. Given this projected correctional flow, the robust upward trend expected in the current daily trend prediction is likely to be adjusted, and there is a possibility of the daily trend temporarily entering the Bearish zone around the end of December to early January. Dec 19, 2023 ◆ Closed price 4,808.60 0.64% ◆ Appropriate Investment Position: Bullish-Buy [Long-term strategy] ◆ Today's Buy-Sell intensity analysis The current trend appears to be 'Uptrend'. The OPEN-price started with a weaker upward rate than the current trend and The H