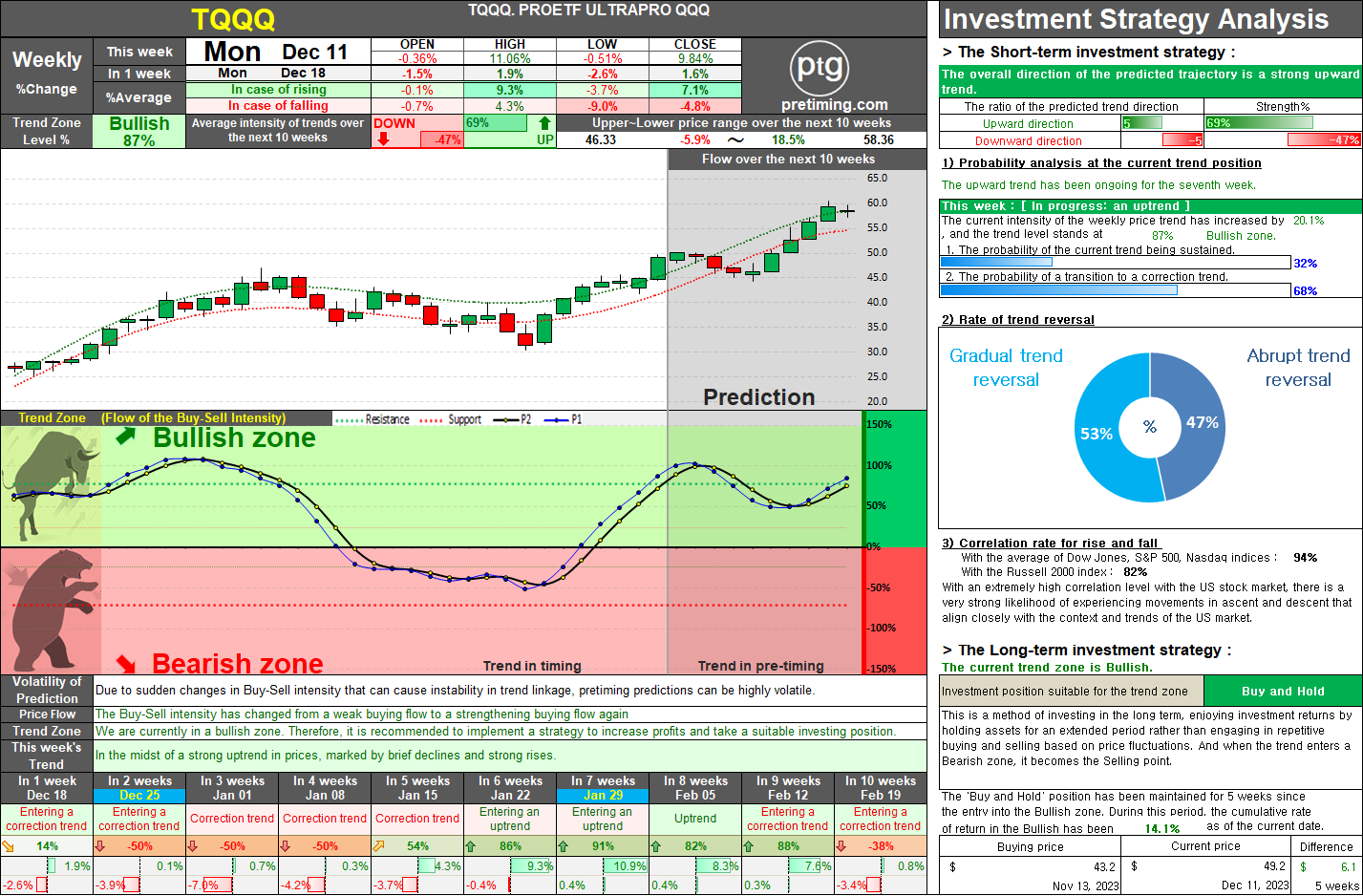

TQQQ: Weekly Forecast Navigating Near-Term Challenges for Long-Term Gains

The weekly trend of TQQQ entered the Bullish zone five weeks ago, and a favorable upward trend is ongoing, consistently pushing the highs higher. Based on the direction of the trend, it has maintained an upward flow for the seventh consecutive week. In the short term, it is expected that from next week onwards, the buying momentum will gradually weaken, indicating a potential entry into a correction trend. This trend is expected to transition to an overall correction trend by early to mid-January, about two weeks later. Subsequently, a trend indicating a return to an upward trajectory is anticipated. In the short term, the flow is expected to fluctuate around the resistance level of $50, serving as a short-term peak. Over the next few weeks, buying strength is expected to be weak, and selling pressure may temporarily intensify. This forecast suggests that there will be periods of weaker buying and temporary strengthening of selling pressure in the coming weeks. Dec 11, 2023 ◆ Closed pr