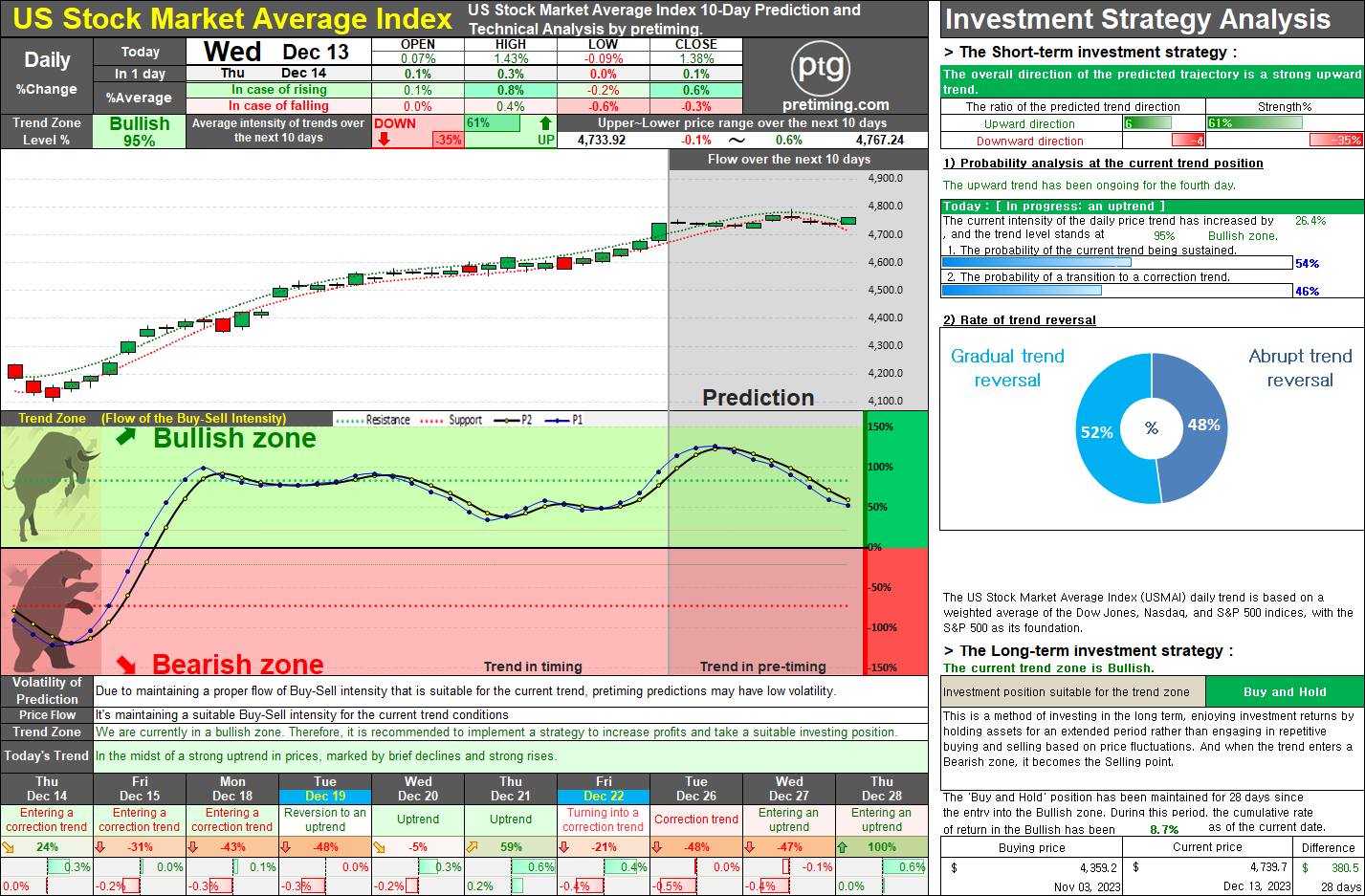

USMAI: Daily Trend Analysis: Bullish Momentum Continues Amid Powell's Dovish Remarks

Introduction: The USMAI daily trend remains firmly in the bullish zone, signaling a sustained upward trajectory. Just yesterday, there were indications of entering a correction phase, as buying strength appeared to wane, but today's sharp ascent follows Federal Reserve Chair Powell's dovish remarks, reinforcing expectations of a rate cut in 2024. Despite the current robust upward movement, signs point to an imminent peak, with the likelihood of a restrained ascent giving way to a corrective trend, leading to a consolidation phase. Key Points: Yesterday's Correction Signals: Until recently, the market exhibited signs of entering a correction phase, marked by diminishing buying strength and a potential shift in momentum. Powell's Dovish Impact: Today's sudden surge is attributed to Federal Reserve Chair Powell's dovish stance, particularly emphasizing the increased certainty of a 2024 interest rate cut. This has injected renewed optimism into the market. Poten