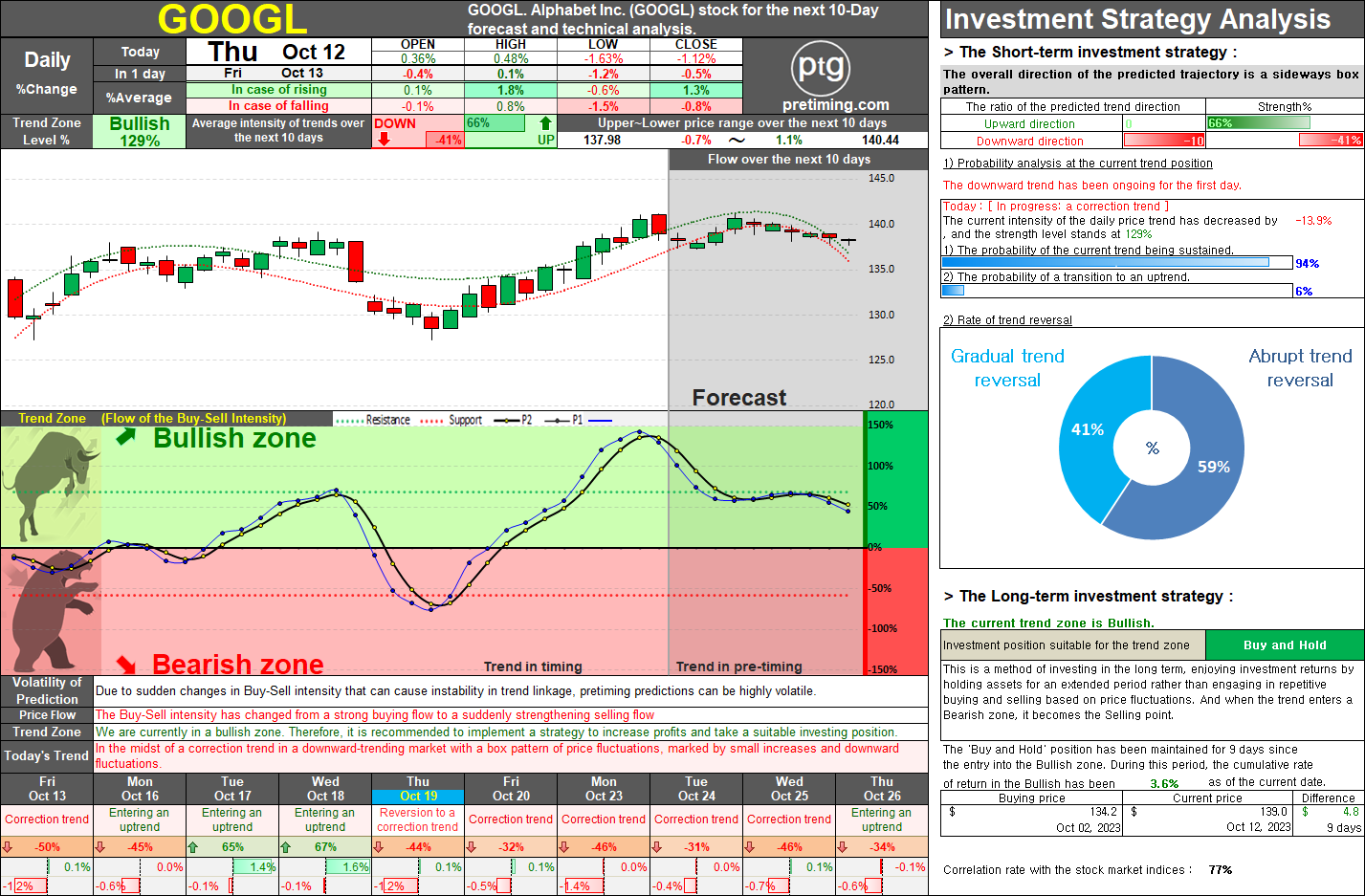

GOOGL Stock Analysis: Navigating the Current Trend and Anticipating Key Market Shifts.

The daily price of GOOGL has transitioned into a corrective trend since October 12th, interrupting the 9-day upward momentum. Considering recent market fluctuations, today's decline indicates a relatively strong downward movement with increased selling pressure. The overall trend is expected to continue in the corrective mode, with a minor attempt to enter an uptrend early next week. However, a complete shift to an upward trend seems unlikely, remaining within the boundaries of the corrective trend. By mid-October, the trend is likely to weaken further, possibly entering the Bearish zone with increasing downward pressure. The similarity with the US market index is at a high level of 77%, but the prediction may vary slightly based on overall market conditions. Currently positioned at 129% within the Bullish zone, there is some time before entering the Bearish zone, allowing for a gradual correction and a potential return to an uptrend. However, as we approach next week, reaching aro