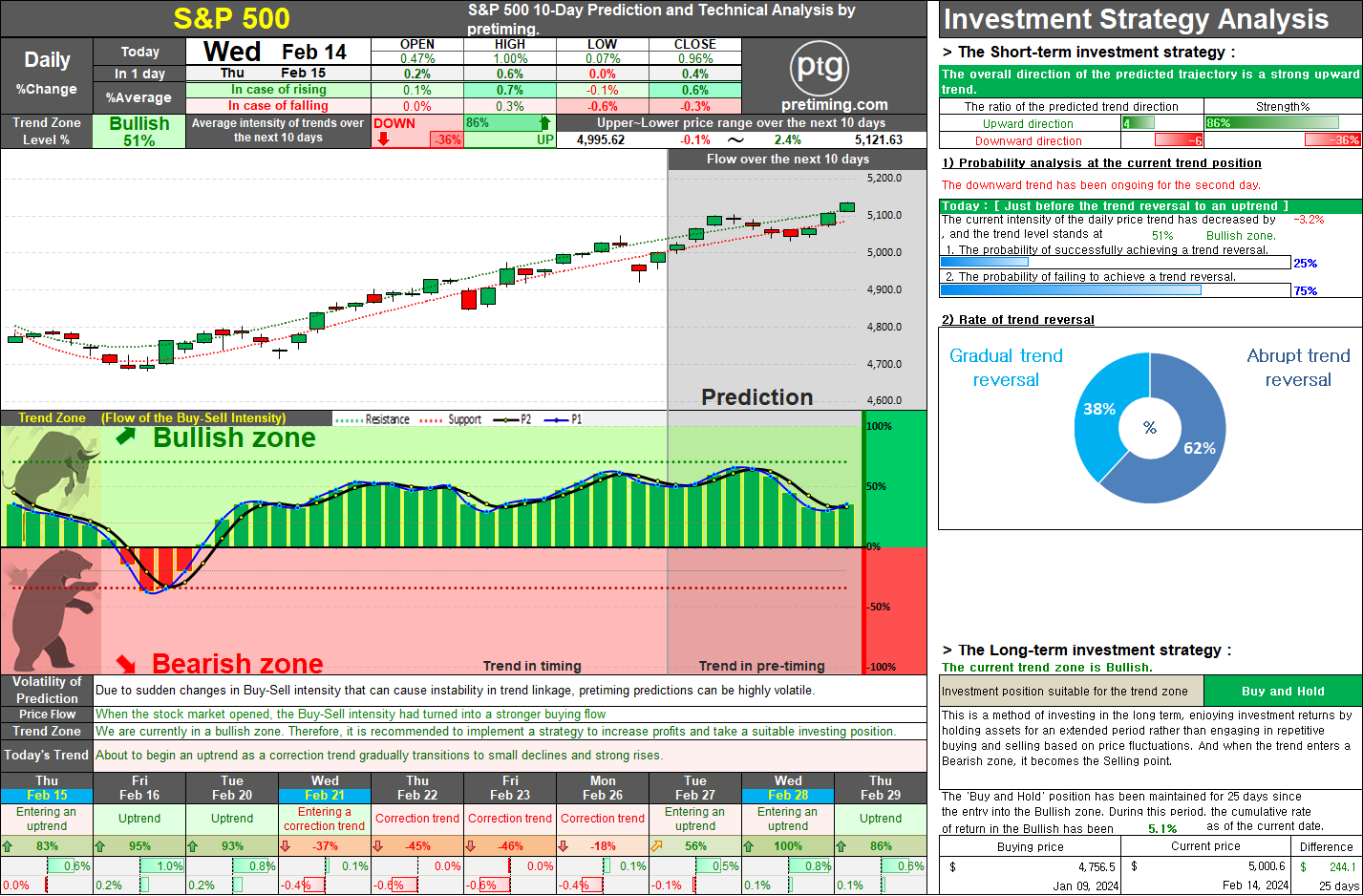

S&P500. Market Analysis and Investment Strategies: Navigating Short-Term Volatility and Long-Term Bullish Trends in the S&P 500.

The market experienced a sharp decline yesterday following the release of CPI figures exceeding consensus estimates. However, we're witnessing a quick recovery today, indicating a restoration of balance between buying and selling pressures in the short term. While there was a temporary disruption in the equilibrium between buying and selling forces, it's now stabilizing. Yet, this resurgence in buying pressure is anticipated to last only until early to mid-next week, after which we may see a weakening of buying strength leading to a downward trend resurfacing. Should buying pressure weaken more than expected and selling pressure intensify, there's a high likelihood that the daily trend could diverge from the anticipated strong upward trajectory post next week. Additionally, if the daily trend enters the Bearish zone, there's ample room for the overall trend to shift downwards. Feb 14, 2024 S&P 500 closing price 5,000.6 0.96%