USMAI. Comprehensive Analysis and Strategy Guide for US Stock Market Trends and Investment Opportunities.

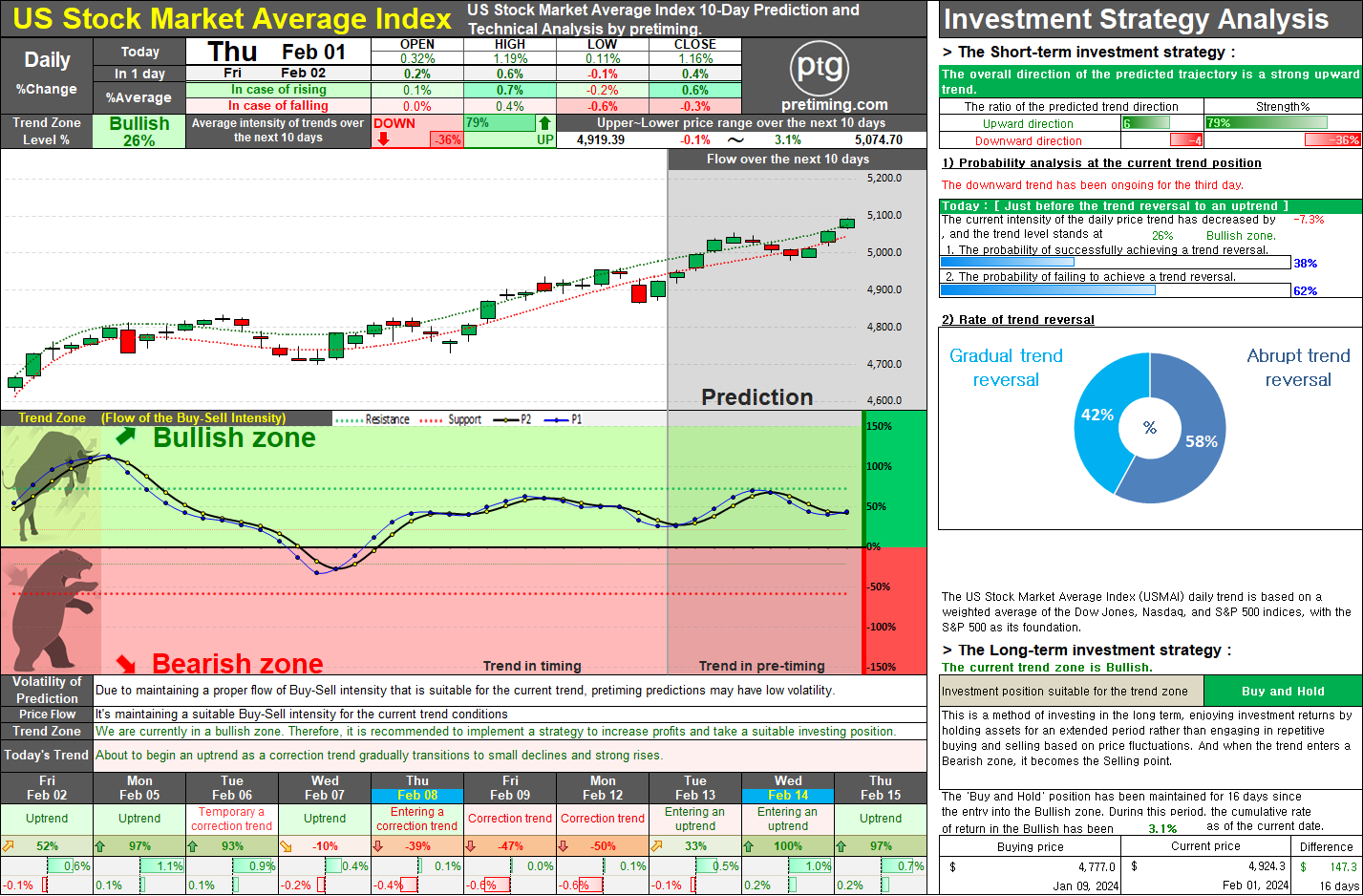

The market reacted negatively to the higher-than-expected CPI figures, sparking a sharp decline that intensified throughout the day, resulting in a closing in the red. There was a rapid shift in buying and selling intensity. While short-term expectations suggest a rebound to offset the initial decline, from a medium to long-term perspective, it appears that we are entering a corrective phase starting from February. Feb 13, 2024 US Stock Market Average Index closing price 4,963.1 -1.52% ◆ [Long-term strategy] The current trend zone is Bullish. and Investment position suitable for the trend zone is Buy and Hold. The trend within a Bullish zone is divided into an 'Uptrend' in the upward direction and a 'Correction Trend' in the downward direction. In the Uptrend, there is a strong upward flow with occasional downward movements, while in the Correction Trend, there is a fluctuating flow in