NVDA Stock Forecast: Analyzing Trends with a Focus on US Stock Market Correlation.

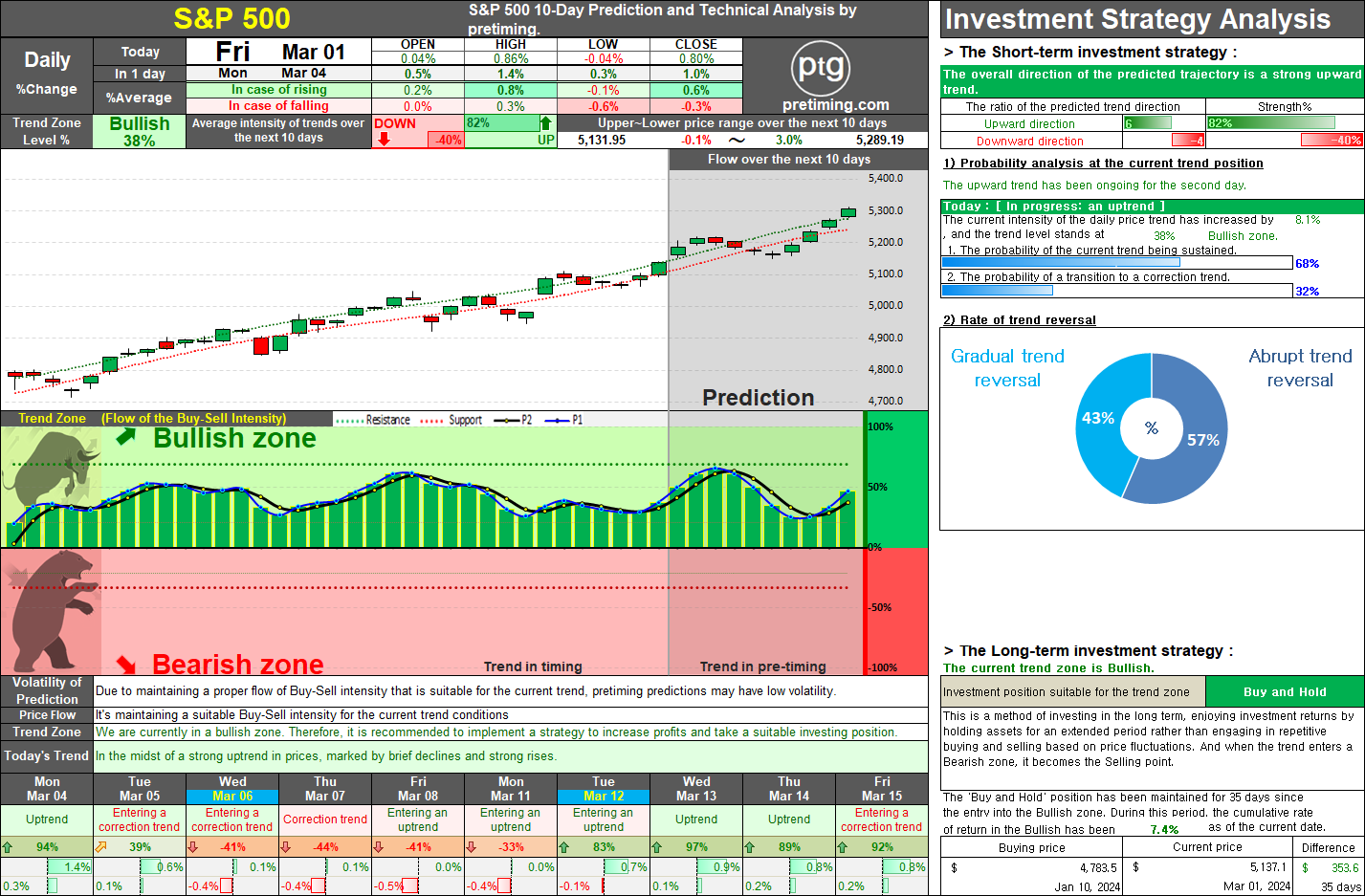

The daily stock price of NVDA has been on an upward trend for the past 6 days; however, it entered a correction trend starting from October 12th. It appears that a correction trend will continue tomorrow, and there will be fluctuations in the overall trend for a while. In the short term, there will be limited fluctuations between rises and falls until early next week. Afterward, there might be a brief upward trend, followed by a continuation of the correction trend. The overall trend is expected to be within a trading range. It shows about 72% similarity with the movement of the US stock market. Therefore, although the trend direction and timing might differ based on the index movement, it is anticipated that the US stock market will progress similarly. Hence, significant changes are not expected. Oct 12, 2023 ◆ Closed price 469.45 0.30% ◆ Appropriate Investment Position: Bullish-Buy [Long-term strategy] ◆ Today's stock price Buy-Sell intensity analysis The current trend appe