Market Analysis: Challenges in Sustaining Recent Upward Trend.

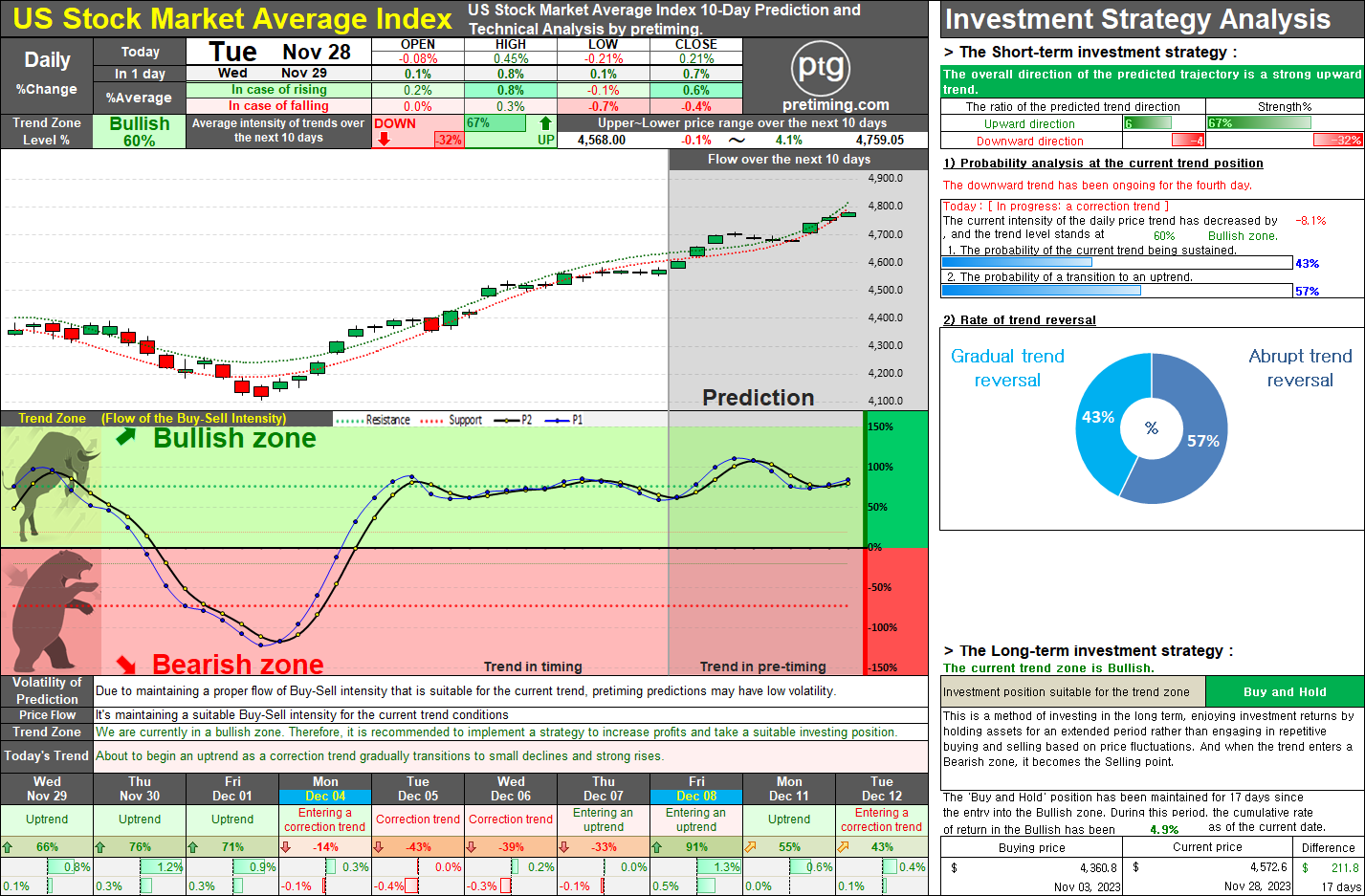

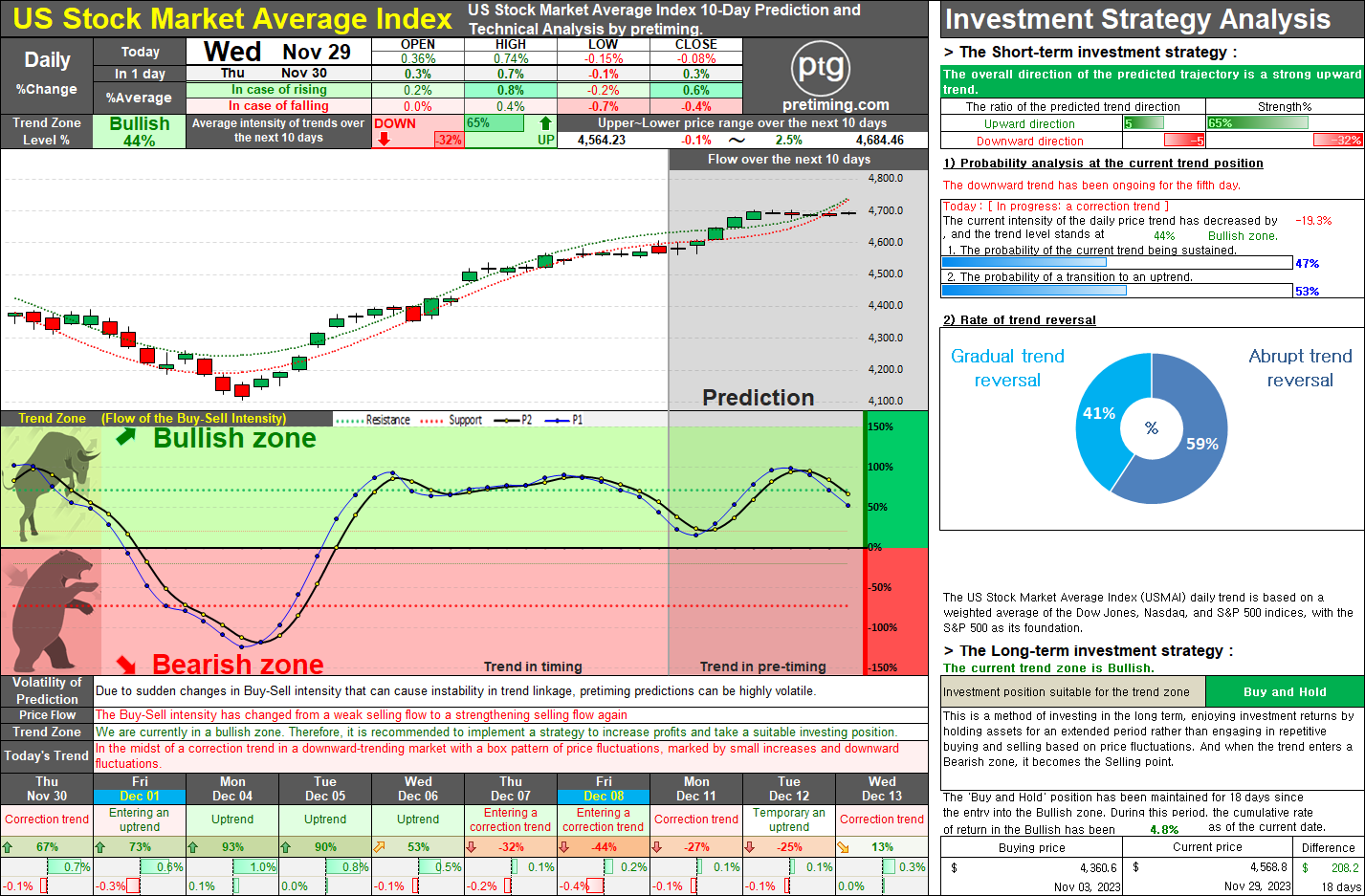

The daily trend of the US stock market average index had shown signs of entering an upward trend from the previous day, and on November 29th, today, it exhibited a promising upward momentum, transitioning into an uptrend. However, it failed to sustain the upward momentum during the trading session, with buying strength weakening, leading to a closing in a slightly consolidating manner. Despite this current state, the overall outlook suggests a reversion to a corrective trend, yet it is anticipated that the market will soon display a renewed inclination towards an upward trend. Nov 29, 2023 ◆ Closed price 4,568.80 -0.08% ◆ Appropriate Investment Position: Bullish-Buy [Long-term strategy] ◆ Today's Buy-Sell intensity analysis The current trend appears to be 'Correction trend'. The OPEN-price started with a stronger upward rate than the current trend and The HIGH and LOW prices are showing a stronger HIGH-price and a weaker LOW-price Finally, the CLOSE-price closed wi