USMAI: Weekly US Market Composite Index: Navigating the Current Correction Trend and Future Projections for 2024.

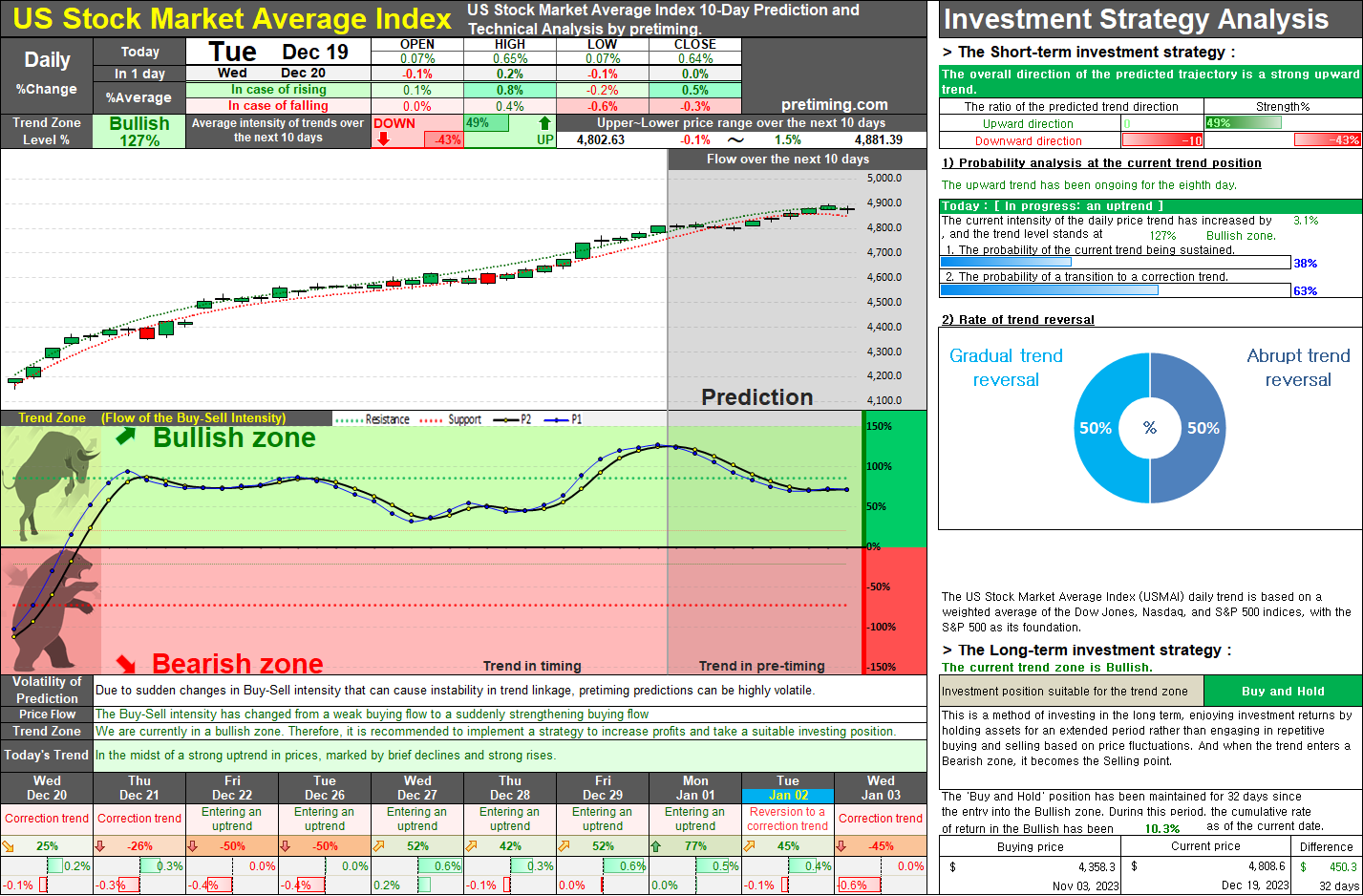

This week, the weekly trend of the US Market Composite Index (USMAI) appears to be showing signs of entering a correction trend. It is likely to undergo a transition to a correction trend soon, and a correction trend is anticipated over the next 2 to 3 weeks. Following this, around mid to late January, there seems to be a trend indicating a transition back to an upward trend. However, this is expected to be a brief phase, and afterwards, a strengthening selling pressure is likely to emerge, indicating an overall increase in selling intensity. The currently predicted target of a 5000-point increase is subject to a high likelihood of change, and even if reached, there is a very high probability that it will be a temporary peak. In February, the possibility of entering the Bearish zone is gradually increasing. Looking at the overall trend of 2024 divided into the first and second halves, the first half seems to exhibit a generally bearish trend, while as we approach the second half, the b