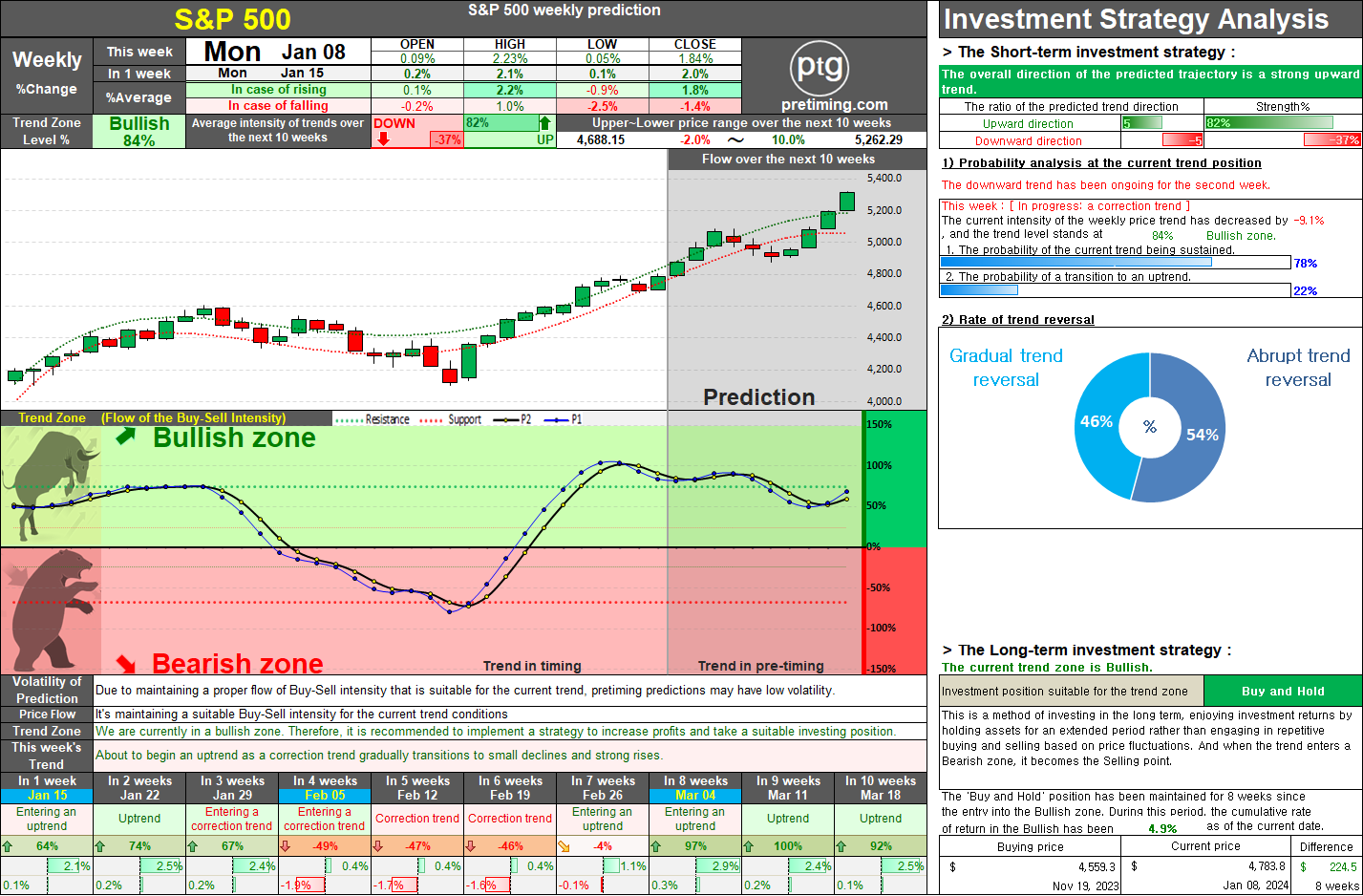

S&P 500. Insights into S&P 500 Trends and Potential Shifts.

The weekly trend of the S&P 500 index is currently undergoing a correction in the Bullish zone. This week, there is a visible strengthening of buying momentum during the correction trend, indicating a potential re-entry into the upward trend. This trend is expected to continue into the following week. Until the end of January, a strong buying momentum is anticipated, but as we move into February, the buying strength is expected to wane, leading to the emergence of a correction trend. Starting from February, there are signs that selling pressure will gradually intensify, raising the likelihood of entering the Bearish zone. Jan 08, 2024 ◆ Closed price 4,783.83 1.84% ◆ Appropriate Investment Position: Bullish-Buy [Long-term strategy] ◆ Thisweek's Buy-Sell intensity analysis The current trend appears to be 'Entering an uptrend'. The OPEN-price started with a stronger upward rate than the current trend and The HIGH and LOW prices are showing an appropriate HIGH-pri