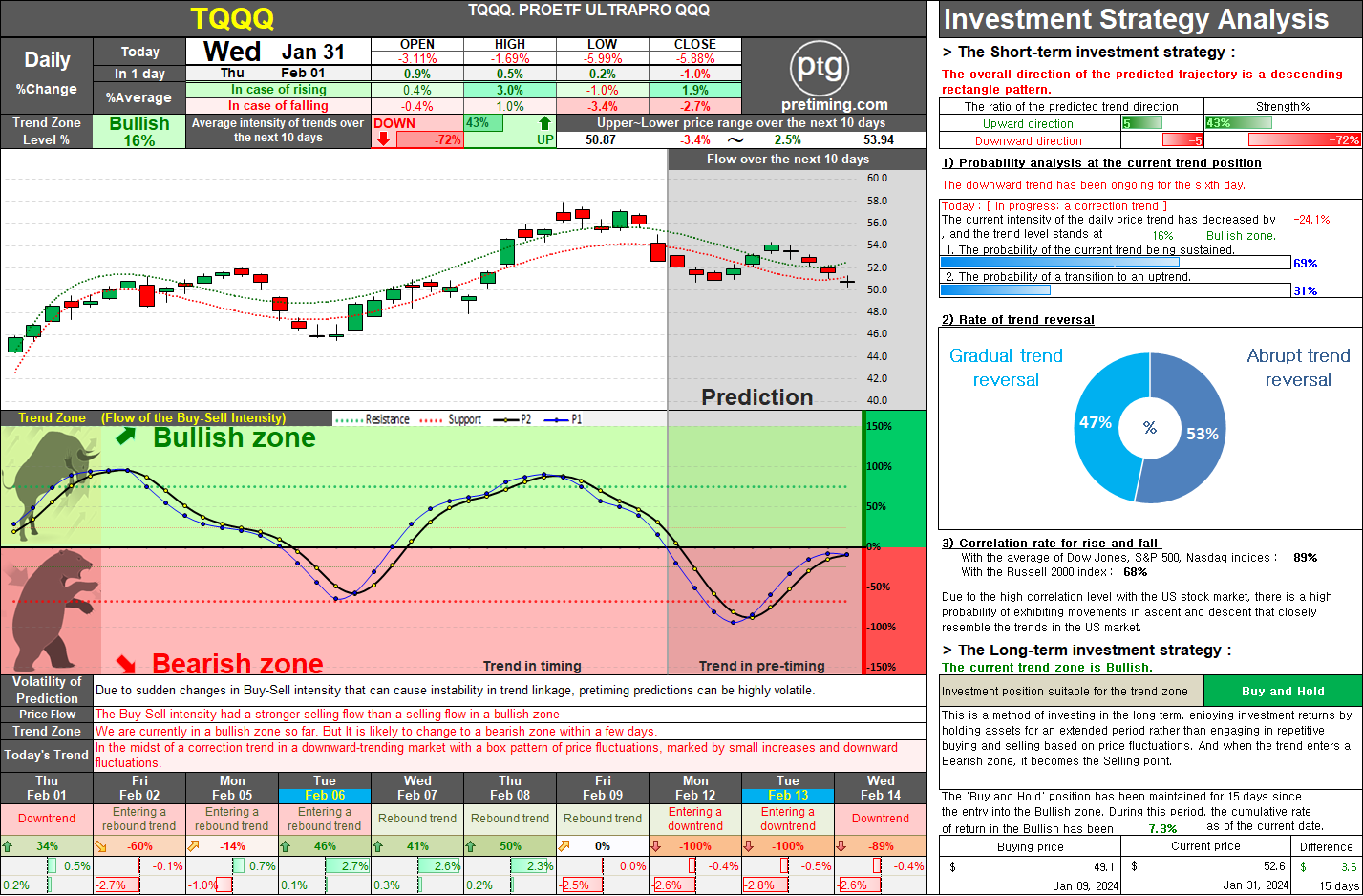

TQQQ. Strategic Insights into TQQQ Stock: Navigating the Transition from Bullish to Bearish - A 10-Day Pretiming Forecast.

In this analysis, we explore the long-term and short-term strategies for TQQQ stock as it undergoes a shift from a Bullish zone to a potential Bearish zone. The long-term strategy emphasizes a 'Buy and Hold' approach during the Bullish trend, while the short-term strategy recommends a cautious 'Sell(Bearish)' position amid an impending change in market dynamics. Key insights include the current trend zone, expected trend movements, suitable investing positions, and precise timing for buying and selling. The analysis also highlights the stock's correlation with the US market, potential volatility, and predictions for trend reversal. Overall, this comprehensive forecast aims to guide investors through the complexities of TQQQ stock in the next 10 days. Jan 31, 2024 TQQQ stock closing price 52.6 -5.88% ◆ [Long-term strategy] The current trend zone is Bullish. and Investment position suitabl