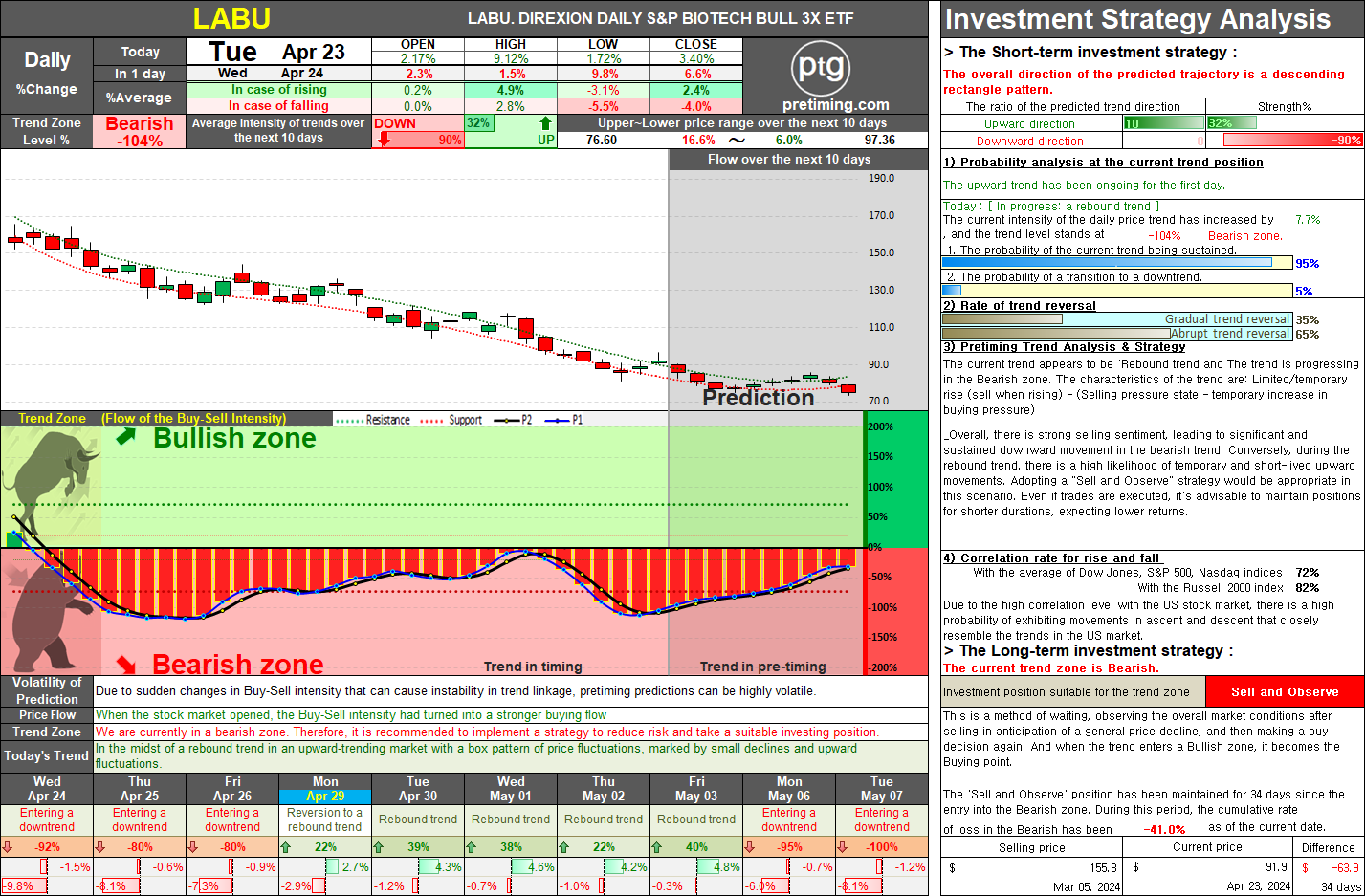

AAPL. The weekly trend for AAPL appears to be in a bearish zone, with a downward trajectory underway. However, there are indications of a short-term entry into a rebound trend.

The weekly trend for AAPL appears to be in a bearish zone, with a downward trajectory underway. However, there are indications of a short-term entry into a rebound trend. Overall, there is a strong selling sentiment, suggesting that during downward trends, the declines are significant and sustained. Even if a rebound trend occurs, it's likely to be temporary, with brief upward movements. In the medium to long term, a 'sell and observe' strategy seems appropriate, and if trading is pursued, it's advisable to keep holding periods short and expectations for returns low. Timing-wise, the current situation indicates a high likelihood of either a brief rebound trend or an immediate continuation of the downward trend. Given the expectation of further declines, it appears prudent to focus on managing downside risks. Apr 01, 2024 AAPL stock closing price 169.4 -1.24% ◆ [Long-term strategy] The current trend zone is Bearish. and Investment p