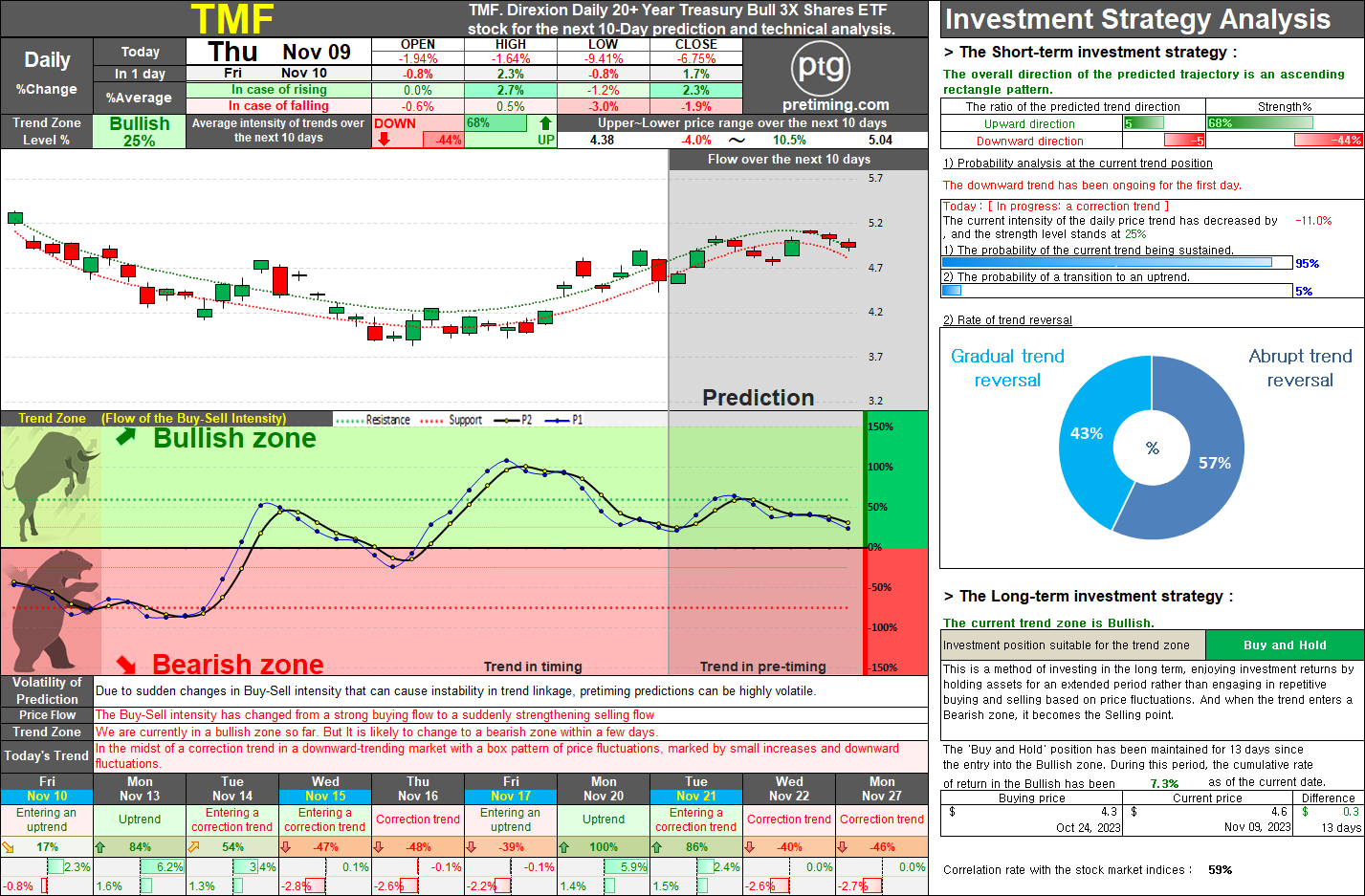

TMF Stock Report: Analyzing Bullish Momentum and Potential Bearish Transition.

TMF. TMF. Direxion Daily 20+ Year Treasury Bull 3X Shares ETF stock for the next 10-Day prediction and technical analysis. Summary: Over the past 13 days, TMF has exhibited a bullish trend, showing a consistent upward trajectory with a cumulative increase of 7.3%. Despite multiple attempts to enter the bullish zone, the stock has encountered resistance, leading to a continuous adjustment trend within the overall bullish momentum. Recent Trends: In recent days, TMF has shown signs of attempting to enter the bullish zone, only to revert to the adjustment trend. Today, the market experienced a sudden downturn due to increased selling pressure triggered by Powell's hawkish remarks and rising bond yields. Currently, the daily trend places TMF in the bullish zone at 25%. Although there is a possibility of entering the bearish zone, short-term rebound buying may lead to another bullish trend for the next 2-3 days. Market Correlation: It is crucial to note that TMF's correlation wit