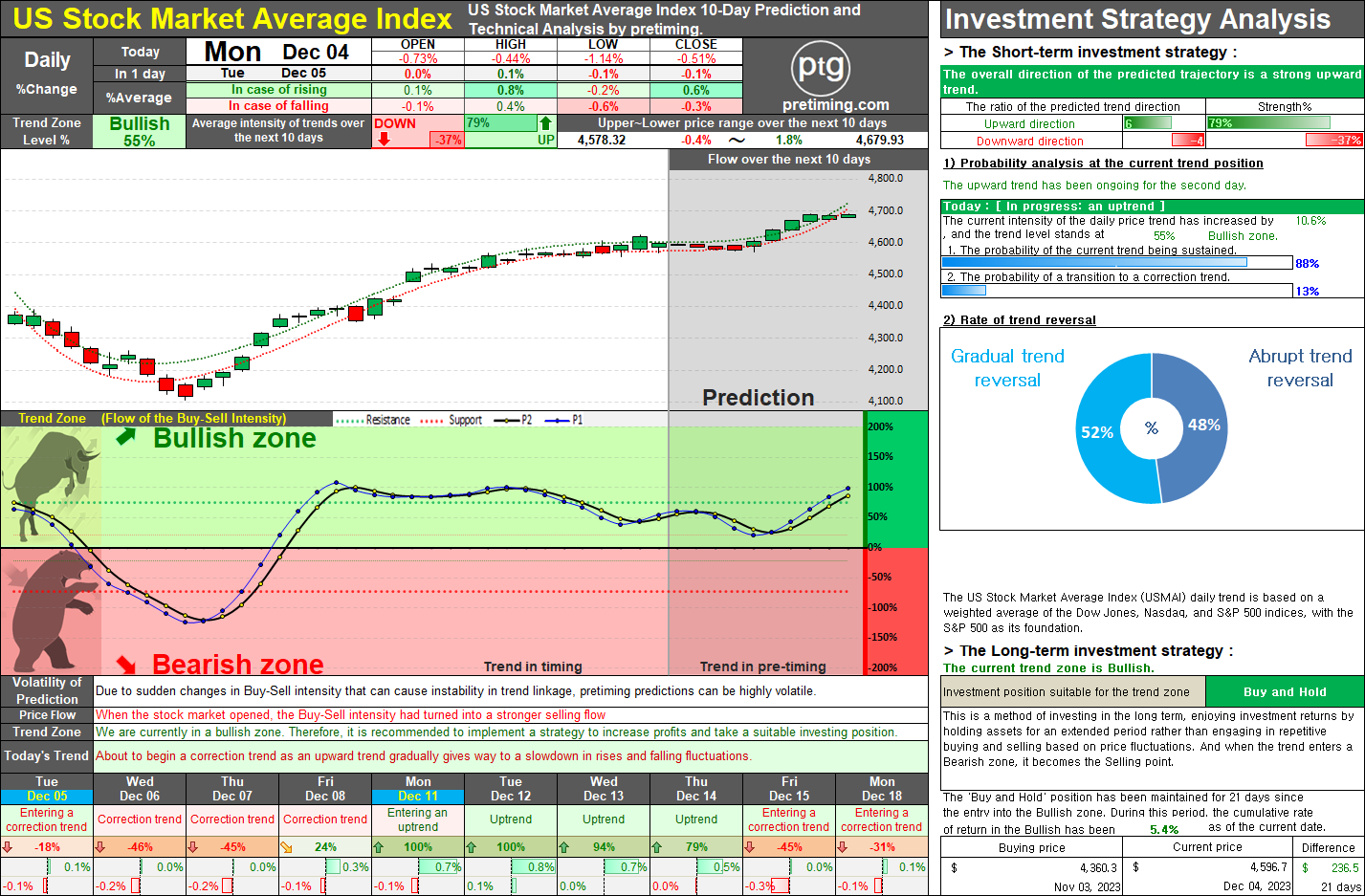

USMAI Market Outlook: Balancing Short-Term Correction Trends and Envisioning Future Bullish Momentum.

[ Over the weekend, we have implemented an update to the Pretiming Analysis Algorithm System. The accuracy of trend data values in the trend zone and the subsequent predictive values have been fine-tuned. As a result, there may be variations between the previous prediction values and trend data values. We kindly ask for your understanding regarding any discrepancies that may arise due to these adjustments. ] Introduction: The USMAI daily trend is currently exhibiting a bullish momentum, marking the second consecutive day of an upward trend. However, there are indications of a potential shift as buying strength weakens and selling pressure temporarily intensifies, as observed on December 4th. This has prompted a move towards a corrective trend, signaling a potential adjustment in the overall trend for this week. Current Trend Analysis: As of now, the market appears to be entering a correction phase, characterized by an overall weakening in bullish sentiment. The decrease in buying inten