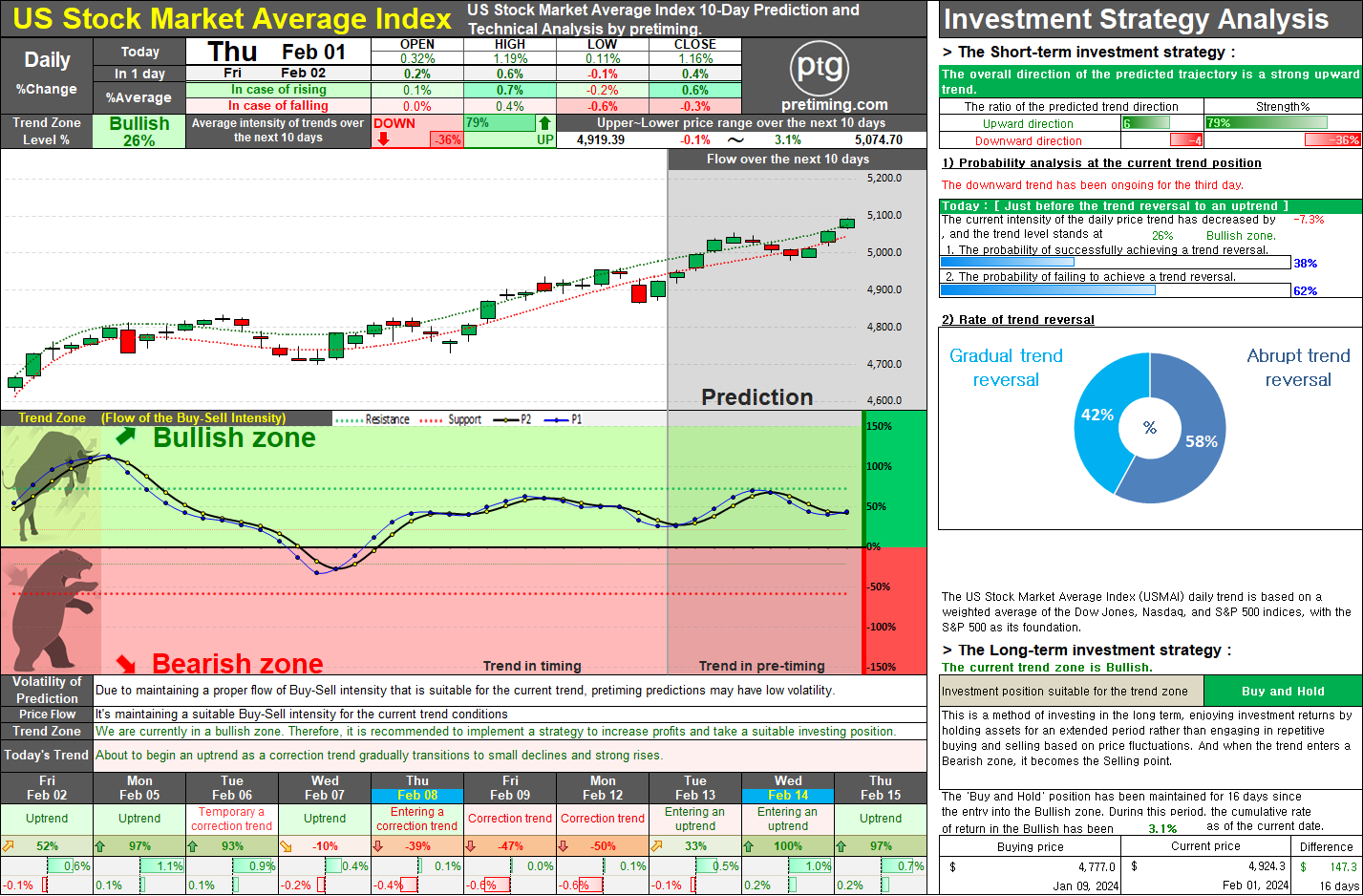

USMAI. Strategic Insights and Projections: Navigating the Current Bullish Trend in the US Stock Market Average Index.

This analysis, conducted on February 1, 2024, focuses on the current state and future projections of the US Stock Market Average Index (USMAI). The long-term strategy suggests a bullish trend, advocating a 'Buy and Hold' position with a cumulative return of 3.1% over 16 days. The short-term strategy emphasizes an upcoming uptrend, recommending a 'Buy(Bullish) and Hold' position with predicted buying and selling dates and prices. The analysis incorporates volatility considerations, turning point probabilities, and a price range forecast over the next 10 days. The average trend zone and intensity percentages are provided, along with potential outcomes in case of market movements. Feb 01, 2024 US Stock Market Average Index closing price 4,924.3 1.16% ◆ [Long-term strategy] The current trend zone is Bullish. and Investment position suitable for the trend zone is Buy and Hold. The trend withi