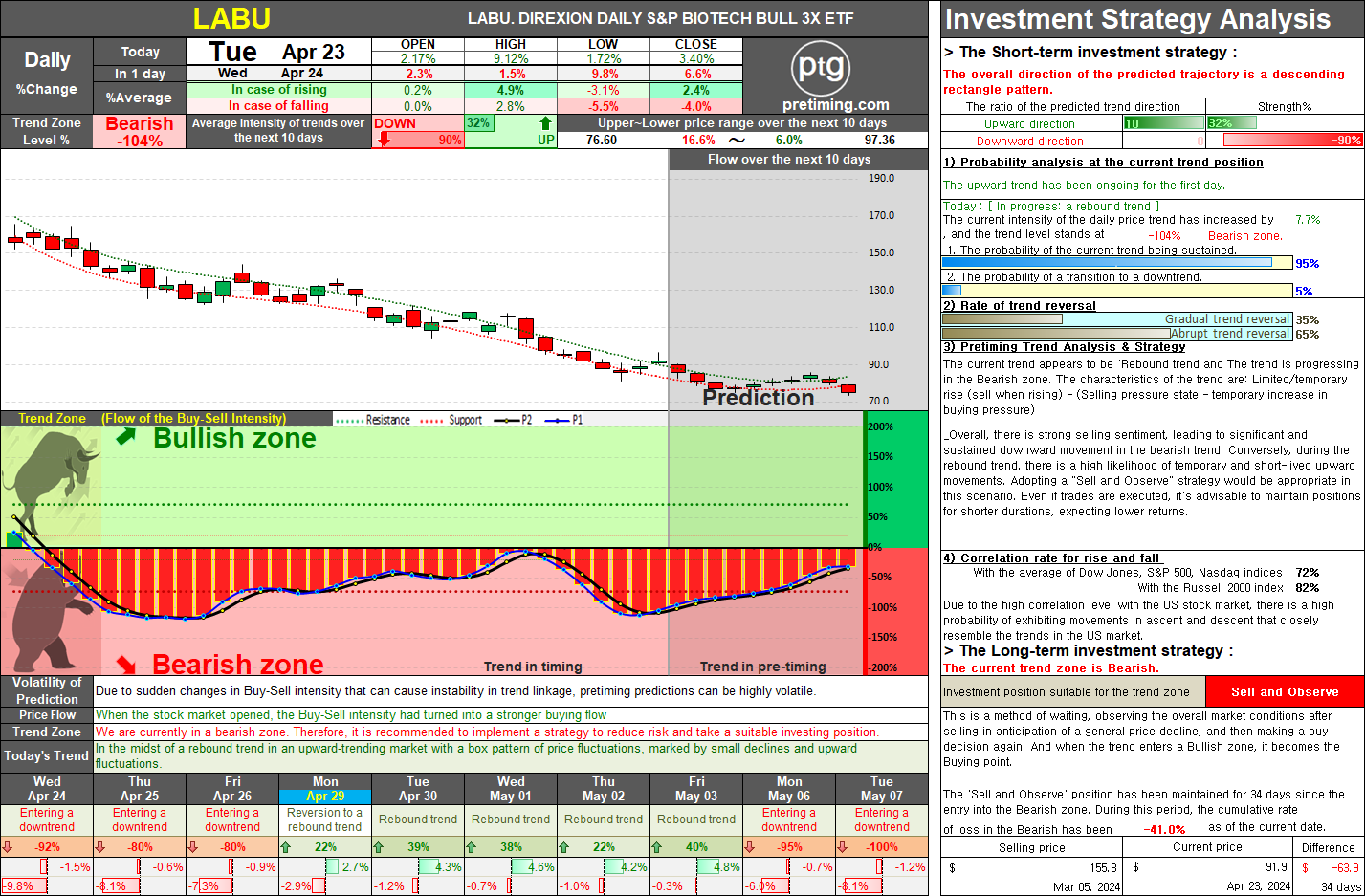

CBOE Volatility Index (VIX). Trend Predictions, Timing, and Intensity Insights.

Apr 23, 2024 CBOE Volatility Index closing price 15.7 -7.38% ◆ [Long-term strategy] The current trend zone is Bearish. and Investment position suitable for the trend zone is Sell and Observe. The trend within a Bearish zone is divided into a 'Downtrend' in the downward direction and a 'Rebound Trend' in the upward direction. In the Downtrend, there is a strong downward flow with occasional upward movements, while in the Rebound Trend, there is a fluctuating flow involving limited or temporary upward movements and downward fluctuations. Investing in this zone is associated with low expected returns and a higher risk of decline. In a Bearish zone, there is potential for strong selling pressure to persist, resulting in a pronounced downward trend and a relatively weak upward rebound trend. When considering a medium to long-term investment strategy, if the tren