GameStop's Road Ahead: Assessing Market Dynamics and Investment Opportunities.

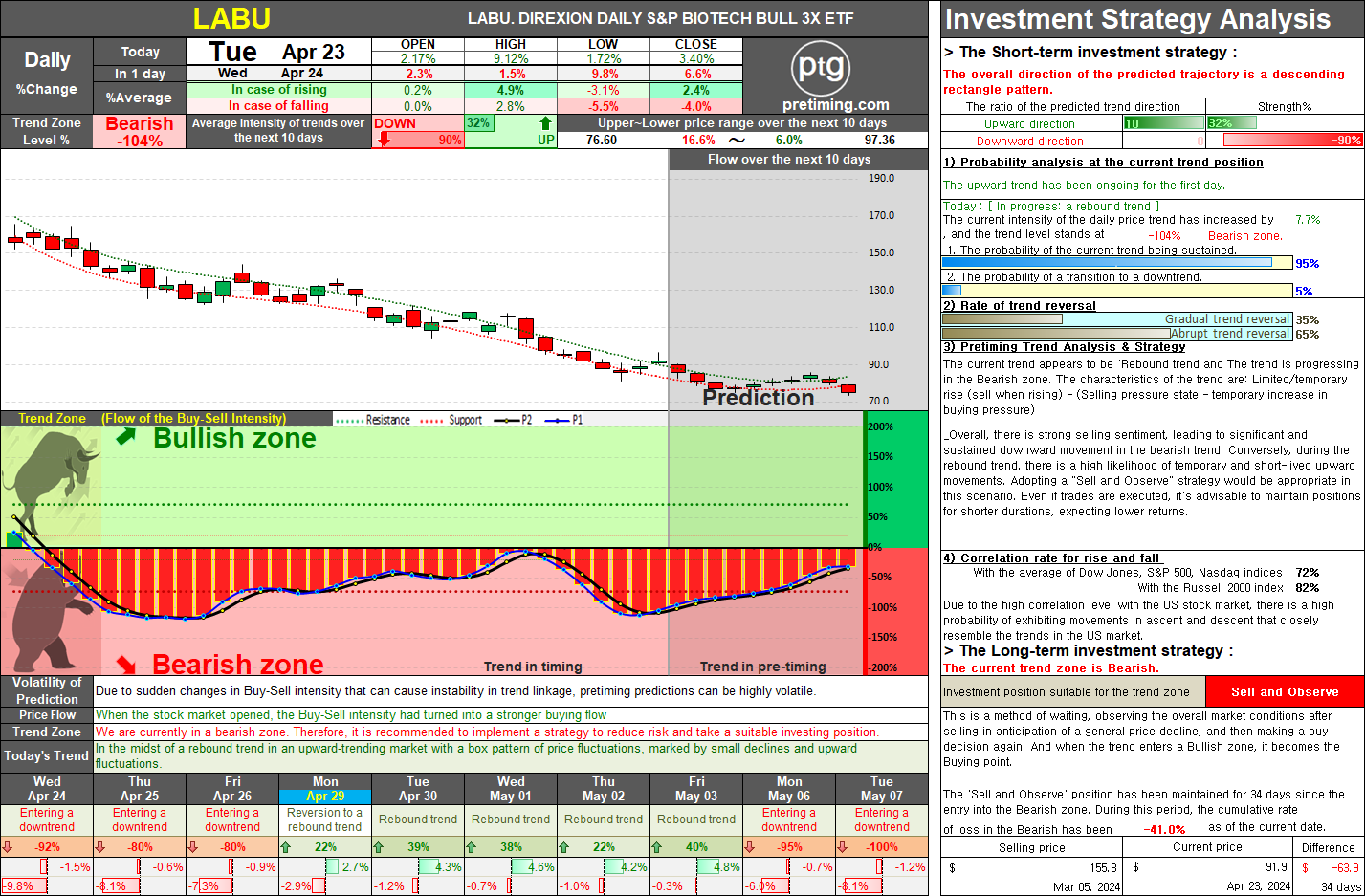

GameStop (GME) Daily Trend Analysis and Future Outlook. Introduction: In recent weeks, GameStop's daily stock prices have displayed a consistent pattern of bearish trends, characterized by significant declines and limited upward movements within the bearish zone. This zone signifies strong selling pressure and weak buying interest. Consequently, prolonged downtrends and limited, temporary upward movements have been observed. Considering these trends, a prudent investment approach involves cautious selling and observing market developments while awaiting opportune moments for purchasing. Current Analysis: The recent market activity demonstrates strong bearish sentiment, with a potential for substantial losses if the downtrend continues. However, short-term indicators suggest a temporary resurgence in buying interest, leading to a notable 8.59% increase in stock prices. While this surge indicates a strengthening buying sentiment, it is likely to stabilize in the next 2-3 days, p